Summary

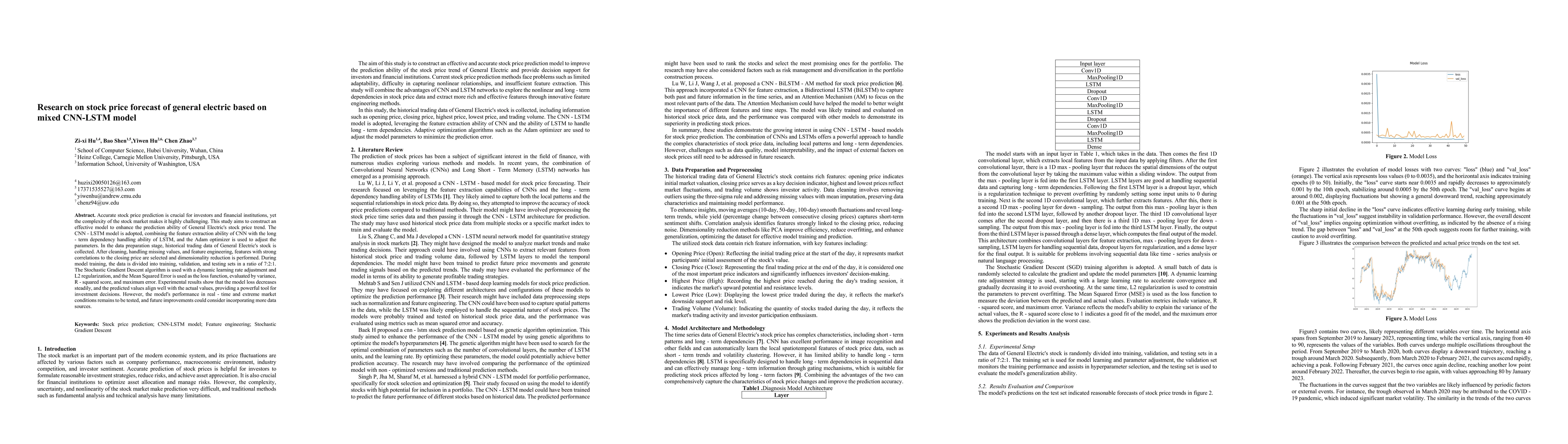

Accurate stock price prediction is crucial for investors and financial institutions, yet the complexity of the stock market makes it highly challenging. This study aims to construct an effective model to enhance the prediction ability of General Electric's stock price trend. The CNN - LSTM model is adopted, combining the feature extraction ability of CNN with the long - term dependency handling ability of LSTM, and the Adam optimizer is used to adjust the parameters. In the data preparation stage, historical trading data of General Electric's stock is collected. After cleaning, handling missing values, and feature engineering, features with strong correlations to the closing price are selected and dimensionality reduction is performed. During model training, the data is divided into training, validation, and testing sets in a ratio of 7:2:1. The Stochastic Gradient Descent algorithm is used with a dynamic learning rate adjustment and L2 regularization, and the Mean Squared Error is used as the loss function, evaluated by variance, R - squared score, and maximum error. Experimental results show that the model loss decreases steadily, and the predicted values align well with the actual values, providing a powerful tool for investment decisions. However, the model's performance in real - time and extreme market conditions remains to be tested, and future improvements could consider incorporating more data sources.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersAttention-based CNN-LSTM and XGBoost hybrid model for stock prediction

Jian Wu, Yang Hu, Zhuangwei Shi et al.

No citations found for this paper.

Comments (0)