Summary

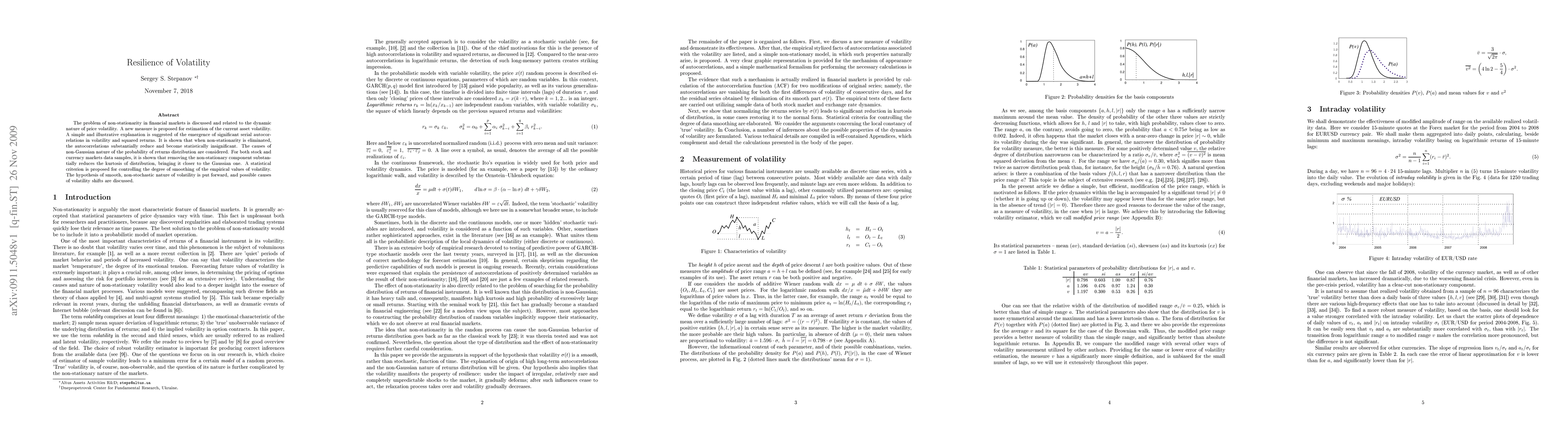

The problem of non-stationarity in financial markets is discussed and related to the dynamic nature of price volatility. A new measure is proposed for estimation of the current asset volatility. A simple and illustrative explanation is suggested of the emergence of significant serial autocorrelations in volatility and squared returns. It is shown that when non-stationarity is eliminated, the autocorrelations substantially reduce and become statistically insignificant. The causes of non-Gaussian nature of the probability of returns distribution are considered. For both stock and currency markets data samples, it is shown that removing the non-stationary component substantially reduces the kurtosis of distribution, bringing it closer to the Gaussian one. A statistical criterion is proposed for controlling the degree of smoothing of the empirical values of volatility. The hypothesis of smooth, non-stochastic nature of volatility is put forward, and possible causes of volatility shifts are discussed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersResilience and Volatility in Academic Publishing, The Case of the University of Maribor 2004-2023

Mojca Tancer Verboten, Dean Korošak

Local volatility under rough volatility

Peter K. Friz, Paolo Pigato, Stefano De Marco et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)