Summary

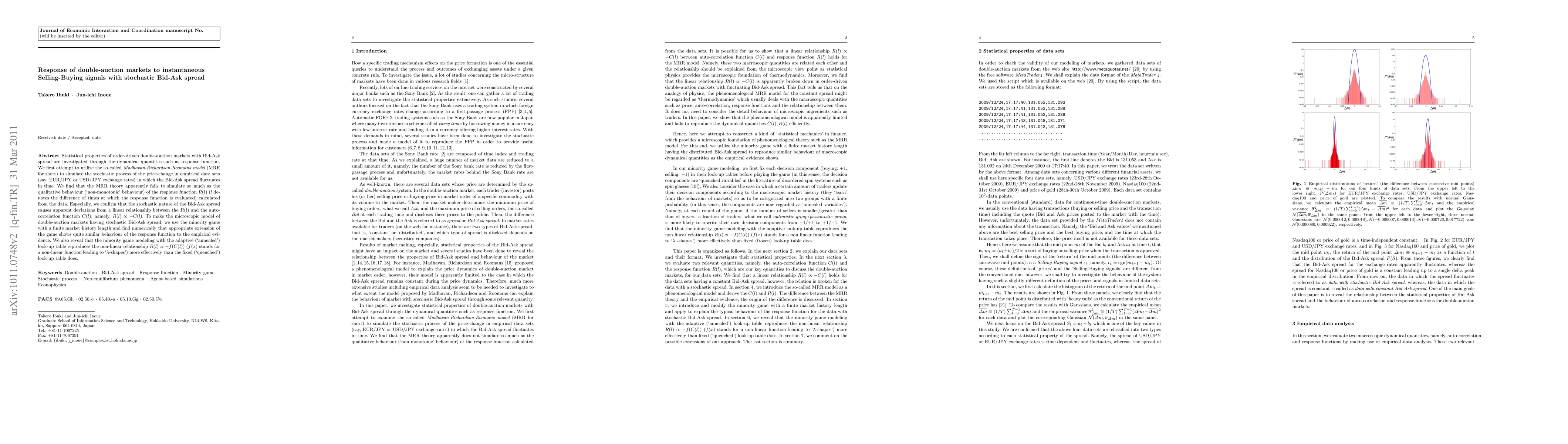

Statistical properties of order-driven double-auction markets with Bid-Ask spread are investigated through the dynamical quantities such as response function. We first attempt to utilize the so-called {\it Madhavan-Richardson-Roomans model} (MRR for short) to simulate the stochastic process of the price-change in empirical data sets (say, EUR/JPY or USD/JPY exchange rates) in which the Bid-Ask spread fluctuates in time. We find that the MRR theory apparently fails to simulate so much as the qualitative behaviour ('non-monotonic' behaviour) of the response function $R(l)$ ($l$ denotes the difference of times at which the response function is evaluated) calculated from the data. Especially, we confirm that the stochastic nature of the Bid-Ask spread causes apparent deviations from a linear relationship between the $R(l)$ and the auto-correlation function $C(l)$, namely, $R(l) \propto -C(l)$. To make the microscopic model of double-auction markets having stochastic Bid-Ask spread, we use the minority game with a finite market history length and find numerically that appropriate extension of the game shows quite similar behaviour of the response function to the empirical evidence. We also reveal that the minority game modeling with the adaptive ('annealed') look-up table reproduces the non-linear relationship $R(l) \propto -f(C(l))$ ($f(x)$ stands for a non-linear function leading to '$\lambda$-shapes') more effectively than the fixed (`quenched') look-up table does.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)