Summary

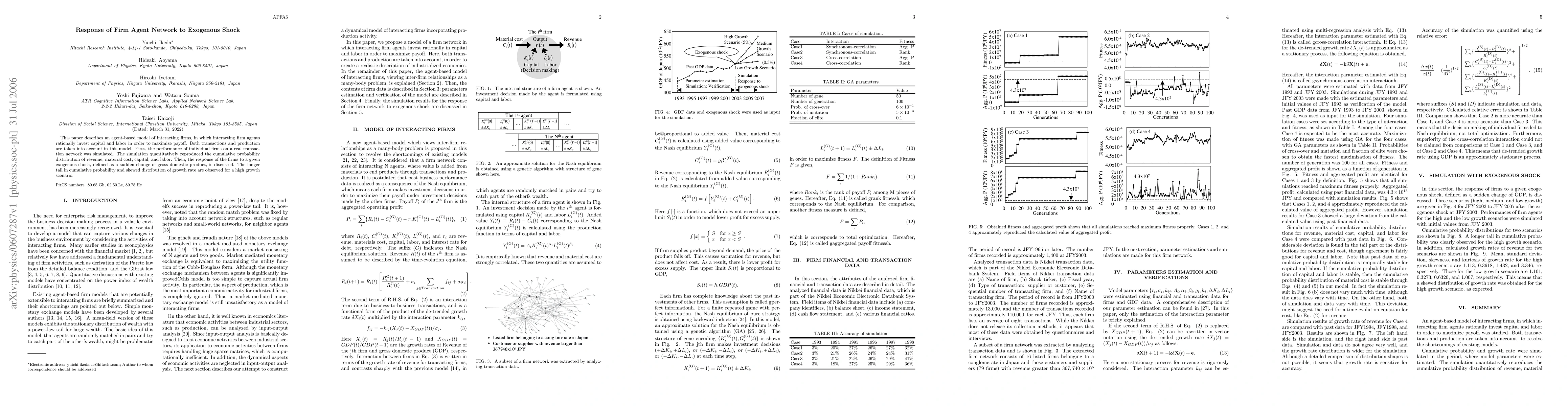

This paper describes an agent-based model of interacting firms, in which interacting firm agents rationally invest capital and labor in order to maximize payoff. Both transactions and production are taken into account in this model. First, the performance of individual firms on a real transaction network was simulated. The simulation quantitatively reproduced the cumulative probability distribution of revenue, material cost, capital, and labor. Then, the response of the firms to a given exogenous shock, defined as a sudden change of gross domestic product, is discussed. The longer tail in cumulative probability and skewed distribution of growth rate are observed for a high growth scenario.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTwo-Sided Market Power in Firm-to-Firm Trade

Alviarez Vanessa, Fioretti Michele, Kikkawa Ken et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)