Authors

Summary

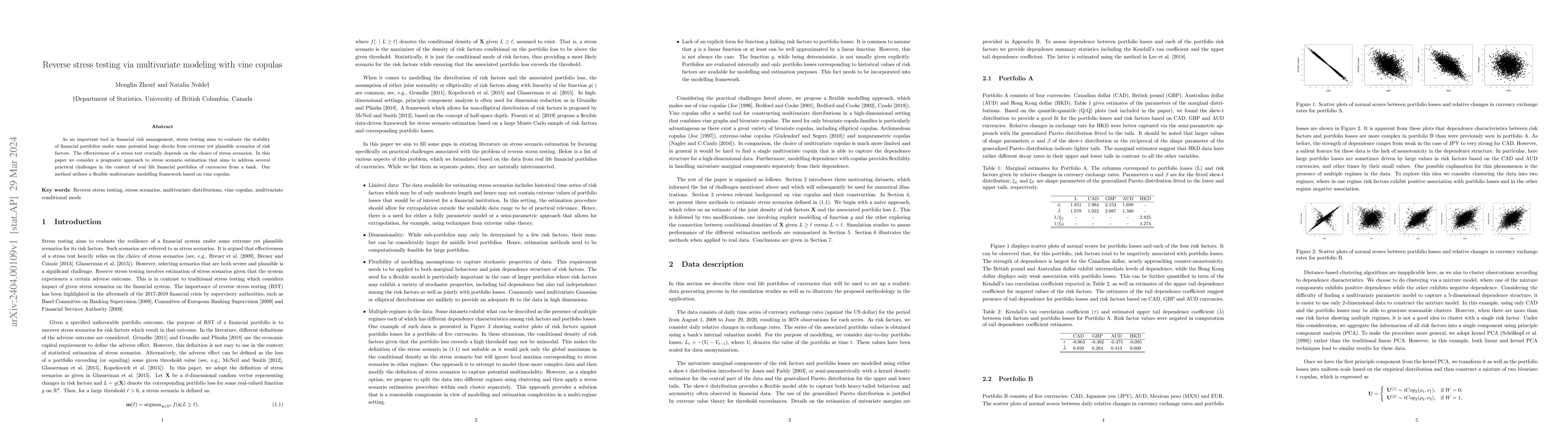

As an important tool in financial risk management, stress testing aims to evaluate the stability of financial portfolios under some potential large shocks from extreme yet plausible scenarios of risk factors. The effectiveness of a stress test crucially depends on the choice of stress scenarios. In this paper we consider a pragmatic approach to stress scenario estimation that aims to address several practical challenges in the context of real life financial portfolios of currencies from a bank. Our method utilizes a flexible multivariate modelling framework based on vine copulas.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersVine Copulas as Differentiable Computational Graphs

Kan Chen, Thomas Nagler, Tuoyuan Cheng et al.

No citations found for this paper.

Comments (0)