Authors

Summary

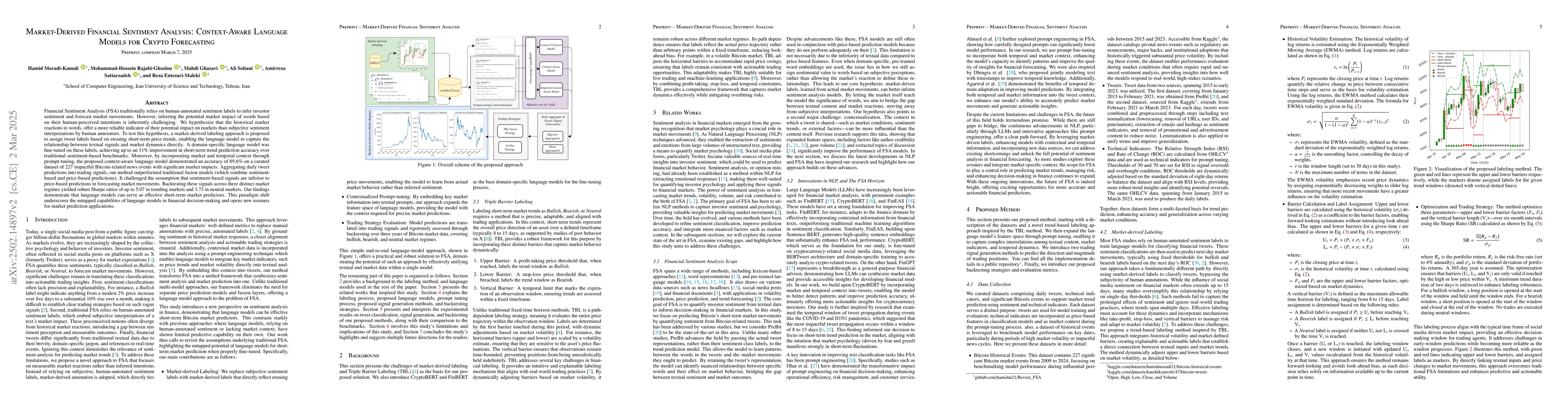

Financial Sentiment Analysis (FSA) traditionally relies on human-annotated sentiment labels to infer investor sentiment and forecast market movements. However, inferring the potential market impact of words based on human-perceived intentions is inherently challenging. We hypothesize that the historical market reactions to words, offer a more reliable indicator of their potential impact on markets than subjective sentiment interpretations by human annotators. To test this hypothesis, a market-derived labeling approach is proposed to assign tweet labels based on ensuing short-term price trends, enabling the language model to capture the relationship between textual signals and market dynamics directly. A domain-specific language model was fine-tuned on these labels, achieving up to an 11% improvement in short-term trend prediction accuracy over traditional sentiment-based benchmarks. Moreover, by incorporating market and temporal context through prompt-tuning, the proposed context-aware language model demonstrated an accuracy of 89.6% on a curated dataset of 227 impactful Bitcoin-related news events with significant market impacts. Aggregating daily tweet predictions into trading signals, our method outperformed traditional fusion models (which combine sentiment-based and price-based predictions). It challenged the assumption that sentiment-based signals are inferior to price-based predictions in forecasting market movements. Backtesting these signals across three distinct market regimes yielded robust Sharpe ratios of up to 5.07 in trending markets and 3.73 in neutral markets. Our findings demonstrate that language models can serve as effective short-term market predictors. This paradigm shift underscores the untapped capabilities of language models in financial decision-making and opens new avenues for market prediction applications.

AI Key Findings

Generated Jun 11, 2025

Methodology

The paper proposes a market-derived labeling approach for financial sentiment analysis (FSA), using language models to capture the relationship between textual signals and market dynamics directly. It fine-tunes a domain-specific language model on these labels, incorporating market and temporal context through prompt-tuning.

Key Results

- The proposed context-aware language model achieved an accuracy of 89.6% on a curated dataset of 227 impactful Bitcoin-related news events.

- The method outperformed traditional fusion models in generating trading signals, challenging the assumption that sentiment-based signals are inferior to price-based predictions.

- Backtesting these signals across three distinct market regimes yielded robust Sharpe ratios of up to 5.07 in trending markets and 3.73 in neutral markets.

- Fine-tuning sentiment models on market-derived labels improved performance, with the CA model achieving F1-scores of 89.5% on the 2020 dataset and 80.3% on an event-sampled dataset.

- The TCA model, incorporating temporal context, demonstrated notable performance on the 2020 dataset (F1-score of 86.5%) but showed reduced performance on the event-sampled dataset, suggesting potential overfitting.

Significance

This research demonstrates that language models can serve as effective short-term market predictors, offering a paradigm shift in financial decision-making and opening new avenues for market prediction applications.

Technical Contribution

The paper introduces a market-derived labeling approach for FSA, fine-tunes language models on these labels, and incorporates market and temporal context through prompt-tuning, demonstrating improved short-term market prediction accuracy.

Novelty

The proposed approach directly links textual inputs and price changes to market movements, overcoming traditional FSA limitations and enhancing predictive and actionable utility by leveraging language models.

Limitations

- The method assumes a direct short-term market impact for each tweet, which may oversimplify the intricate relationship between social media activity and market movements.

- Reliance on prompt engineering introduces the risk of overfitting, as the model might become overly attuned to training data patterns, limiting its ability to generalize to new data.

Future Work

- Investigate the transient nature of specific textual patterns and market trends, requiring frequent model updates to maintain performance.

- Explore the integration of language models with additional external data sources to enhance financial forecasting efficacy.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLarge Language Model Adaptation for Financial Sentiment Analysis

Pau Rodriguez Inserte, Mariam Nakhlé, Raheel Qader et al.

Chinese Fine-Grained Financial Sentiment Analysis with Large Language Models

Wang Xu, Yanru Wu, Yinyu Lan et al.

No citations found for this paper.

Comments (0)