Summary

This paper revisits mean-risk portfolio selection in a one-period financial market, where risk is quantified by a star-shaped risk measure $\rho$. We make three contributions. First, we introduce the new axiom of sensitivity to large expected losses and show that it is key to ensure the existence of optimal portfolios. Second, we give primal and dual characterisations of (strong) $\rho$-arbitrage. Finally, we use our conditions for the absence of (strong) $\rho$-arbitrage to explicitly derive the (strong) $\rho$-consistent price interval for an external financial contract.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

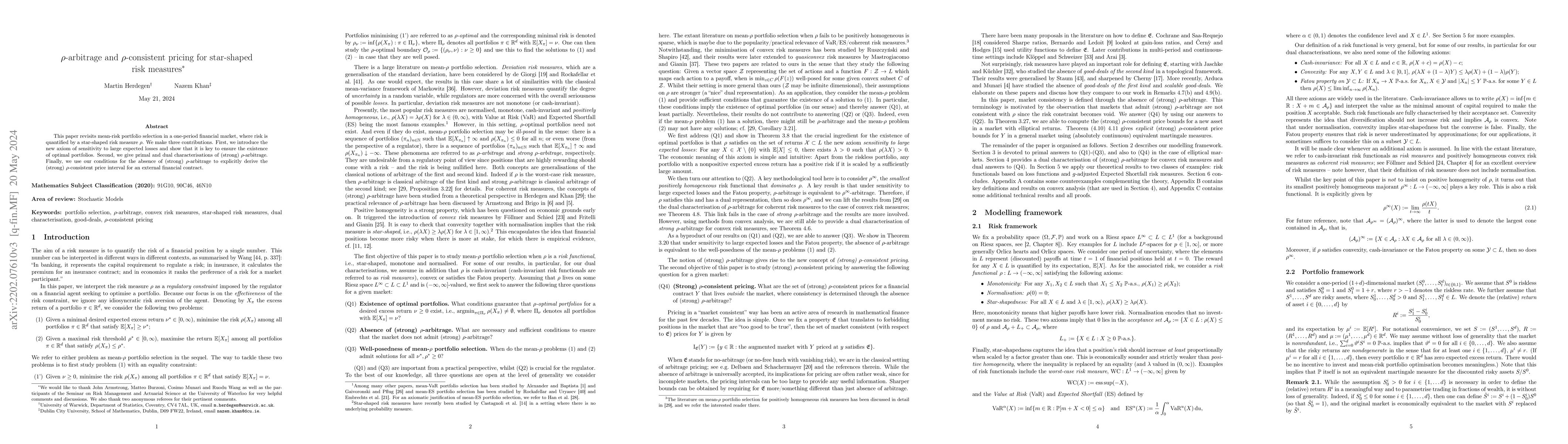

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)