Summary

In this paper, we consider a risk-based optimal investment problem of an insurer in a regime-switching jump diffusion model with noisy memory. Using the model uncertainty modeling, we formulate the investment problem as a zero-sum, stochastic differential delay game between the insurer and the market, with a convex risk measure of the terminal surplus and the Brownian delay surplus over a period $[T-\varrho,T]$. Then, by the BSDE approach, the game problem is solved. Finally, we derive analytical solutions of the game problem, for a particular case of a quadratic penalty function and a numerical example is considered.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

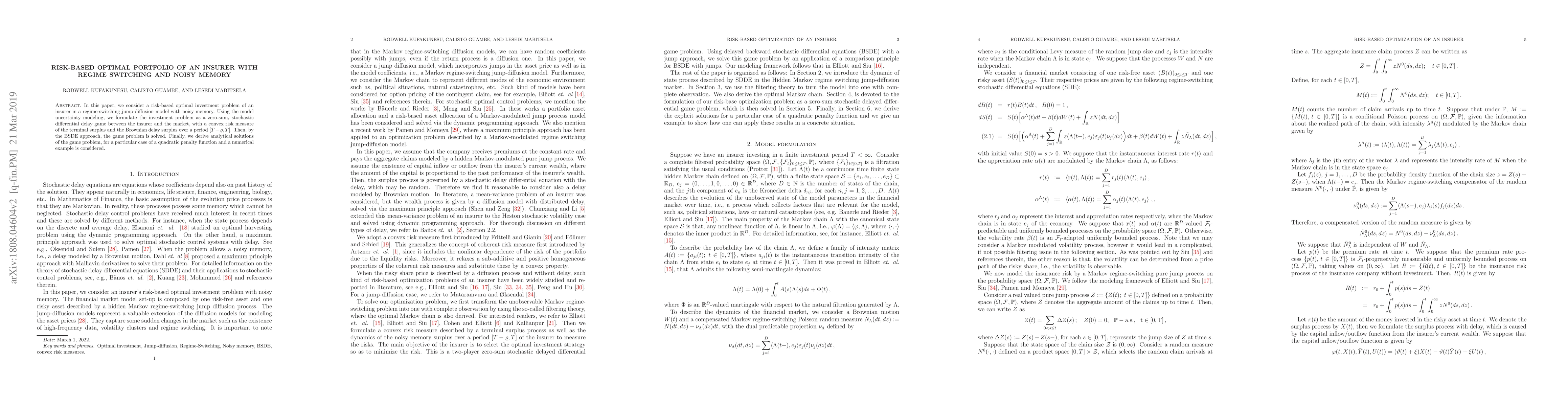

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)