Authors

Summary

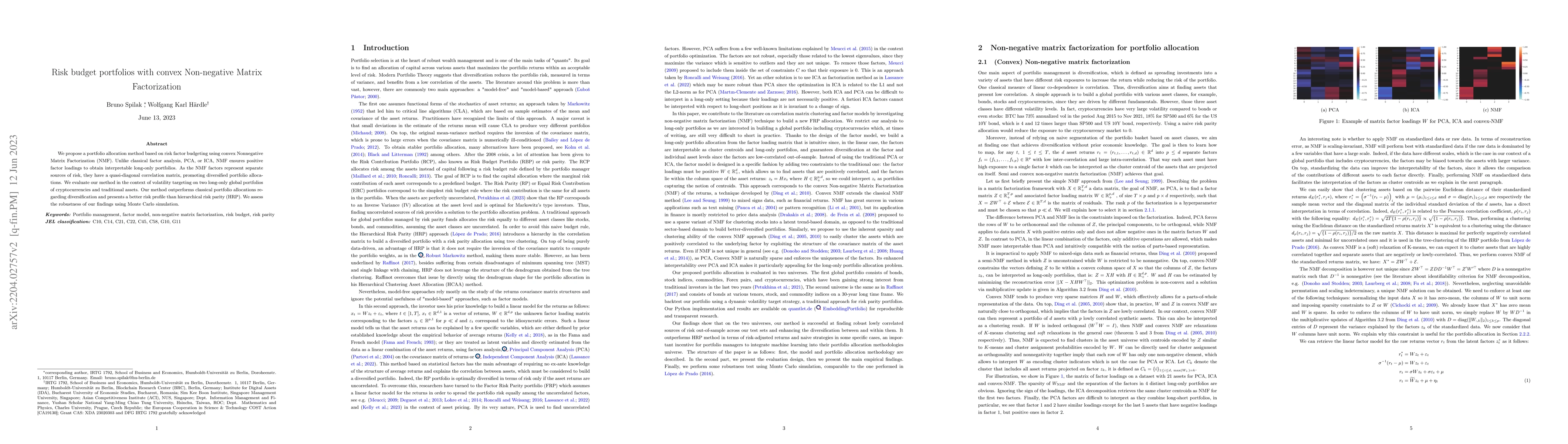

We propose a portfolio allocation method based on risk factor budgeting using convex Nonnegative Matrix Factorization (NMF). Unlike classical factor analysis, PCA, or ICA, NMF ensures positive factor loadings to obtain interpretable long-only portfolios. As the NMF factors represent separate sources of risk, they have a quasi-diagonal correlation matrix, promoting diversified portfolio allocations. We evaluate our method in the context of volatility targeting on two long-only global portfolios of cryptocurrencies and traditional assets. Our method outperforms classical portfolio allocations regarding diversification and presents a better risk profile than hierarchical risk parity (HRP). We assess the robustness of our findings using Monte Carlo simulation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConvex Non-negative Matrix Factorization Through Quantum Annealing

Basarab Matei, Younès Bennani, Ahmed Zaiou et al.

Privacy-preserving Non-negative Matrix Factorization with Outliers

Swapnil Saha, Hafiz Imtiaz

| Title | Authors | Year | Actions |

|---|

Comments (0)