Summary

We consider the classic Kelly gambling problem with general distribution of outcomes, and an additional risk constraint that limits the probability of a drawdown of wealth to a given undesirable level. We develop a bound on the drawdown probability; using this bound instead of the original risk constraint yields a convex optimization problem that guarantees the drawdown risk constraint holds. Numerical experiments show that our bound on drawdown probability is reasonably close to the actual drawdown risk, as computed by Monte Carlo simulation. Our method is parametrized by a single parameter that has a natural interpretation as a risk-aversion parameter, allowing us to systematically trade off asymptotic growth rate and drawdown risk. Simulations show that this method yields bets that out perform fractional-Kelly bets for the same drawdown risk level or growth rate. Finally, we show that a natural quadratic approximation of our convex problem is closely connected to the classical mean-variance Markowitz portfolio selection problem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

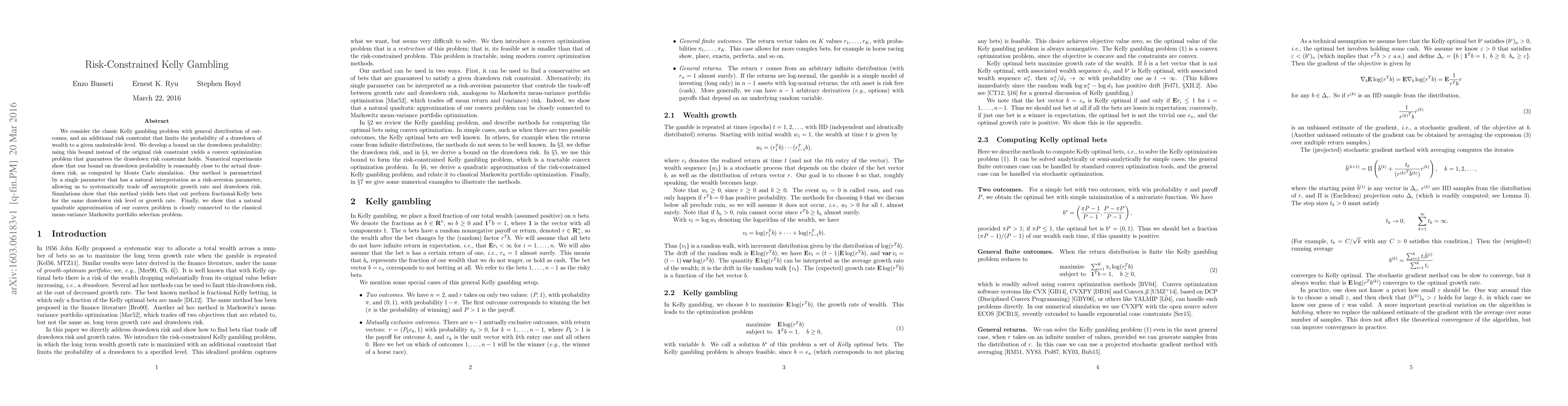

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)