Summary

In classic Kelly gambling, bets are chosen to maximize the expected log growth of wealth, under a known probability distribution. Breiman provides rigorous mathematical proofs that Kelly strategy maximizes the rate of asset growth (asymptotically maximal magnitude property), which is thought of as the principal justification for selecting expected logarithmic utility as the guide to portfolio selection. Despite very nice theoretical properties, the classic Kelly strategy is rarely used in practical portfolio allocation directly due to practically unavoidable uncertainty. In this paper we consider the distributional robust version of the Kelly gambling problem, in which the probability distribution is not known, but lies in a given set of possible distributions. The bet is chosen to maximize the worst-case (smallest) expected log growth among the distributions in the given set. Computationally, this distributional robust Kelly gambling problem is convex, but in general need not be tractable. We show that it can be tractably solved in a number of useful cases when there is a finite number of outcomes with standard tools from disciplined convex programming. Theoretically, in sequential decision making with varying distribution within a given uncertainty set, we prove that distributional robust Kelly strategy asymptotically maximizes the worst-case rate of asset growth, and dominants any other essentially different strategy by magnitude. Our results extends Breiman's theoretical result and justifies that the distributional robust Kelly strategy is the optimal strategy in the long-run for practical betting with uncertainty.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

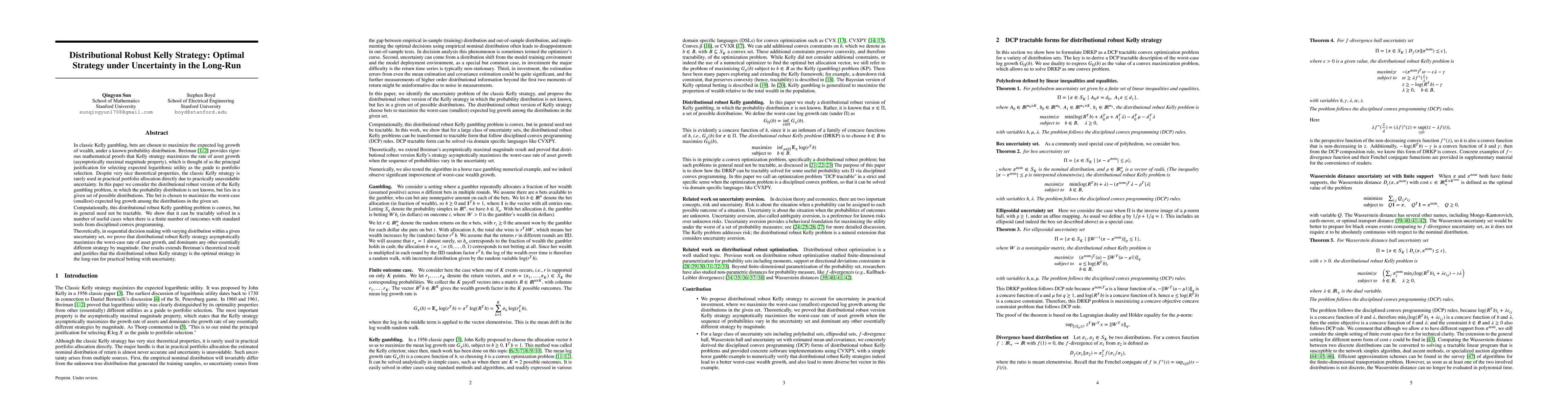

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)