Summary

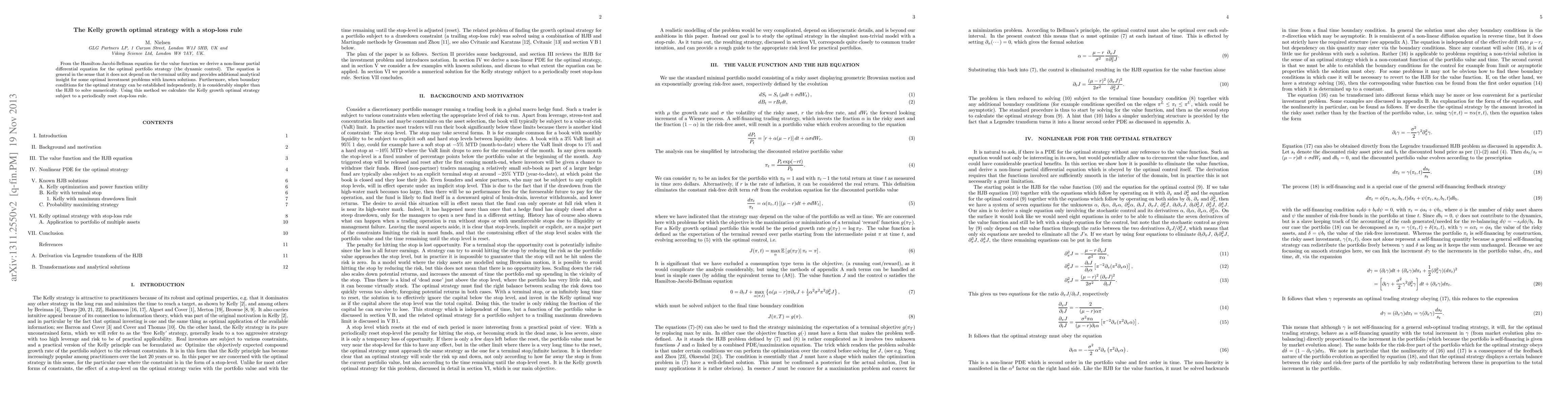

From the Hamilton-Jacobi-Bellman equation for the value function we derive a non-linear partial differential equation for the optimal portfolio strategy (the dynamic control). The equation is general in the sense that it does not depend on the terminal utility and provides additional analytical insight for some optimal investment problems with known solutions. Furthermore, when boundary conditions for the optimal strategy can be established independently, it is considerably simpler than the HJB to solve numerically. Using this method we calculate the Kelly growth optimal strategy subject to a periodically reset stop-loss rule.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)