Authors

Summary

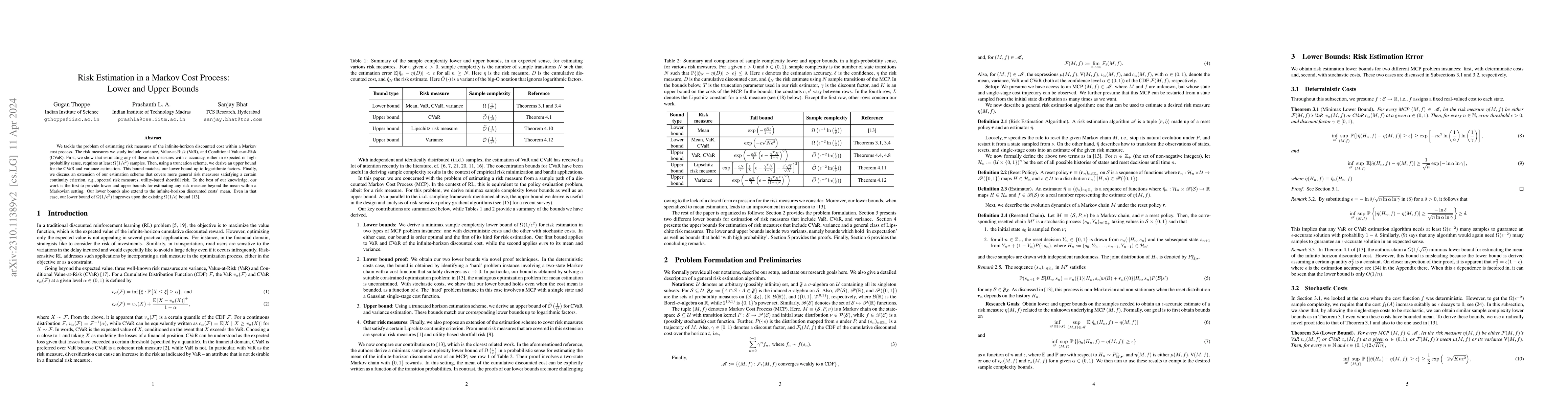

We tackle the problem of estimating risk measures of the infinite-horizon discounted cost within a Markov cost process. The risk measures we study include variance, Value-at-Risk (VaR), and Conditional Value-at-Risk (CVaR). First, we show that estimating any of these risk measures with $\epsilon$-accuracy, either in expected or high-probability sense, requires at least $\Omega(1/\epsilon^2)$ samples. Then, using a truncation scheme, we derive an upper bound for the CVaR and variance estimation. This bound matches our lower bound up to logarithmic factors. Finally, we discuss an extension of our estimation scheme that covers more general risk measures satisfying a certain continuity criterion, e.g., spectral risk measures, utility-based shortfall risk. To the best of our knowledge, our work is the first to provide lower and upper bounds for estimating any risk measure beyond the mean within a Markovian setting. Our lower bounds also extend to the infinite-horizon discounted costs' mean. Even in that case, our lower bound of $\Omega(1/\epsilon^2) $ improves upon the existing $\Omega(1/\epsilon)$ bound [13].

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSubexponential upper and lower bounds in Wasserstein distance for Markov processes

Guodong Pang, Nikola Sandrić, Ari Arapostathis

Subexponential lower bounds for $f$-ergodic Markov processes

Aleksandar Mijatović, Miha Brešar

No citations found for this paper.

Comments (0)