Authors

Summary

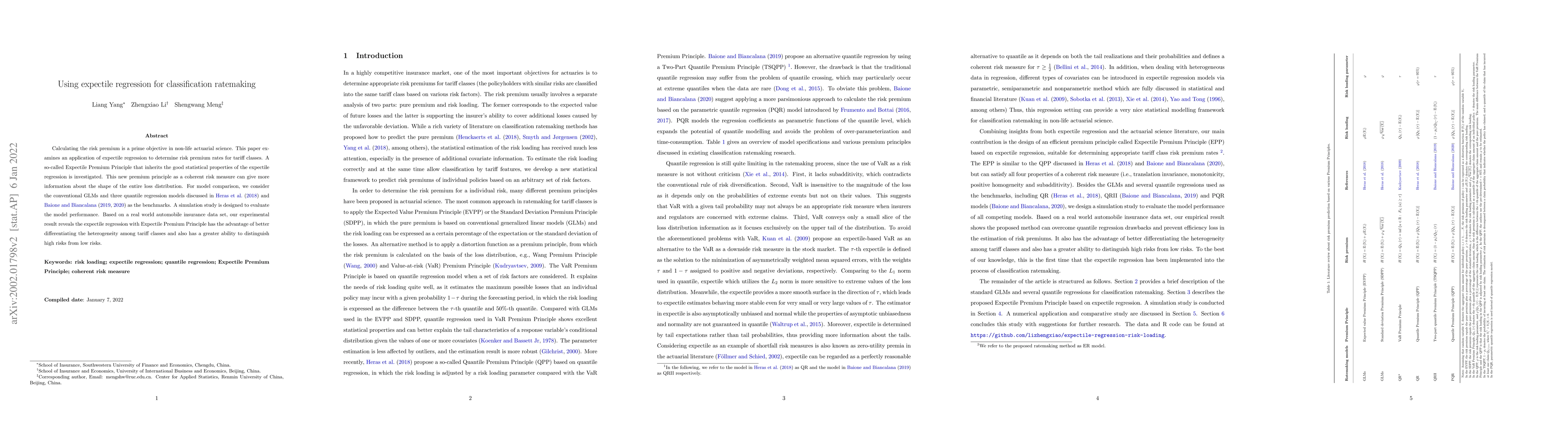

The risk premium of a policy is the sum of the pure premium and the risk loading. In the classification ratemaking process, generalized linear models are usually used to calculate pure premiums, and various premium principles are applied to derive the risk loadings. No matter which premium principle is used, some risk loading parameters should be given in advance subjectively. To overcome this subjective problem and calculate the risk premium more reasonably and objectively, we propose a top-down method to calculate these risk loading parameters. First, we implement the bootstrap method to calculate the total risk premium of the portfolio. Then, under the constraint that the portfolio's total risk premium should equal the sum of the risk premiums of each policy, the risk loading parameters are determined. During this process, besides using generalized linear models, three kinds of quantile regression models are also applied, namely, traditional quantile regression model, fully parametric quantile regression model, and quantile regression model with coefficient functions. The empirical result shows that the risk premiums calculated by the method proposed in this study can reasonably differentiate the heterogeneity of different risk classes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Posteriori Risk Classification and Ratemaking with Random Effects in the Mixture-of-Experts Model

Andrei L. Badescu, X. Sheldon Lin, Tsz Chai Fung et al.

Geographic ratemaking with spatial embeddings

Hélène Cossette, Etienne Marceau, Luc Lamontagne et al.

No citations found for this paper.

Comments (0)