Summary

We study dynamic hedging of counterparty risk for a portfolio of credit derivatives. Our empirically driven credit model consists of interacting default intensities which ramp up and then decay after the occurrence of credit events. Using the Galtchouk-Kunita-Watanabe decomposition of the counterparty risk price payment stream, we recover a closed-form representation for the risk minimizing strategy in terms of classical solutions to nonlinear recursive systems of Cauchy problems. We discuss applications of our framework to the most prominent class of credit derivatives, including credit swap and risky bond portfolios, as well as first-to-default claims.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

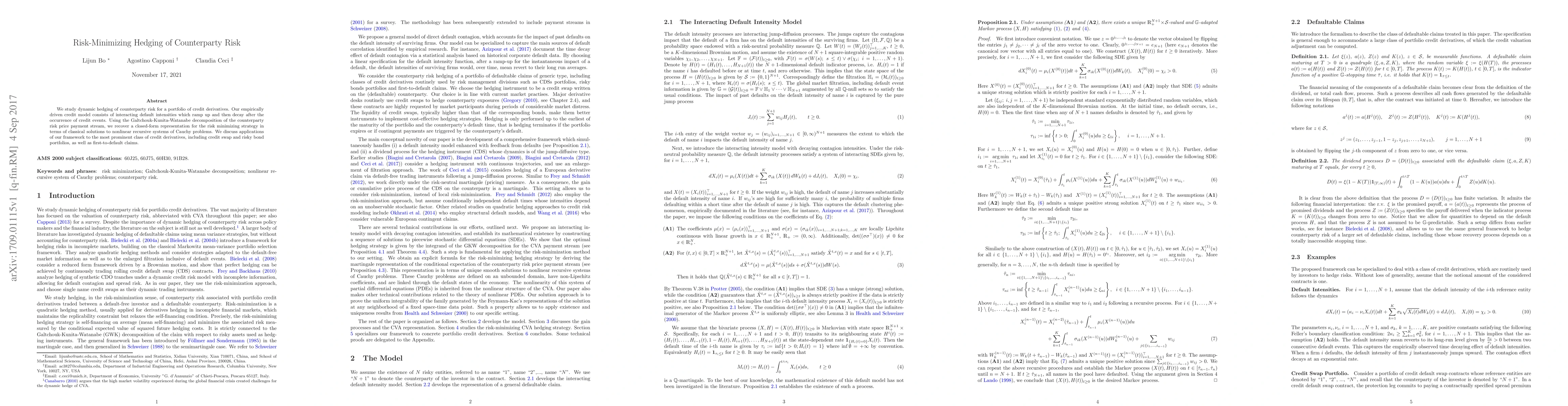

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)