Summary

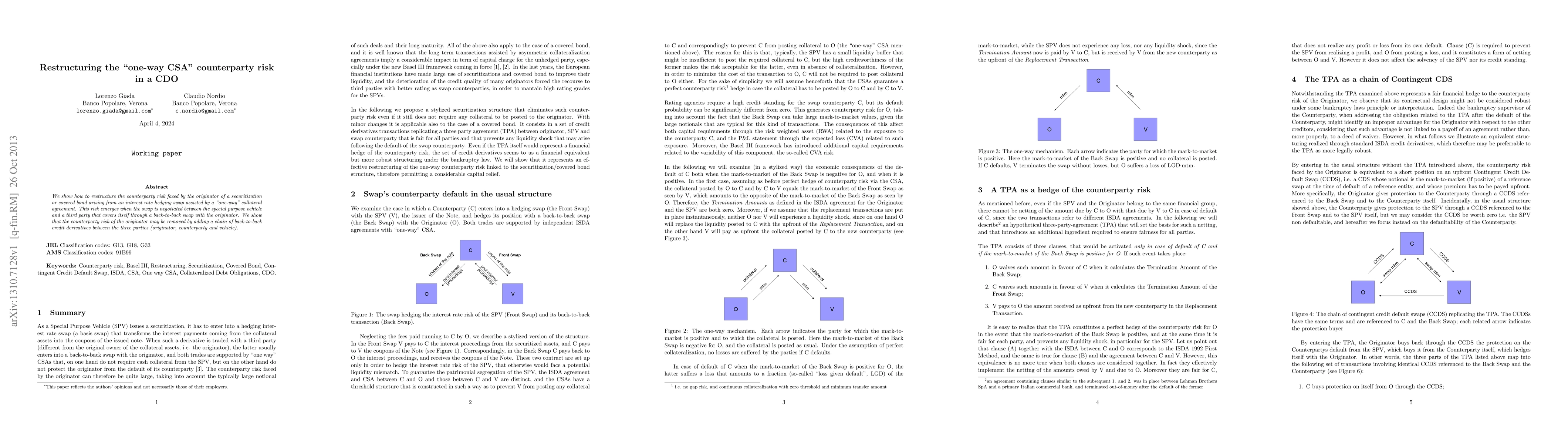

We show how to restructure the counterparty risk faced by the originator of a securitization or covered bond arising from an interest rate hedging swap assisted by a "one-way" collateral agreement. This risk emerges when the swap is negotiated between the special purpose vehicle and a third party that covers itself through a back-to-back swap with the originator. We show that the counterparty risk of the originator may be removed by adding a chain of back-to-back credit derivatives between the three parties (originator, counterparty and vehicle).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)