Summary

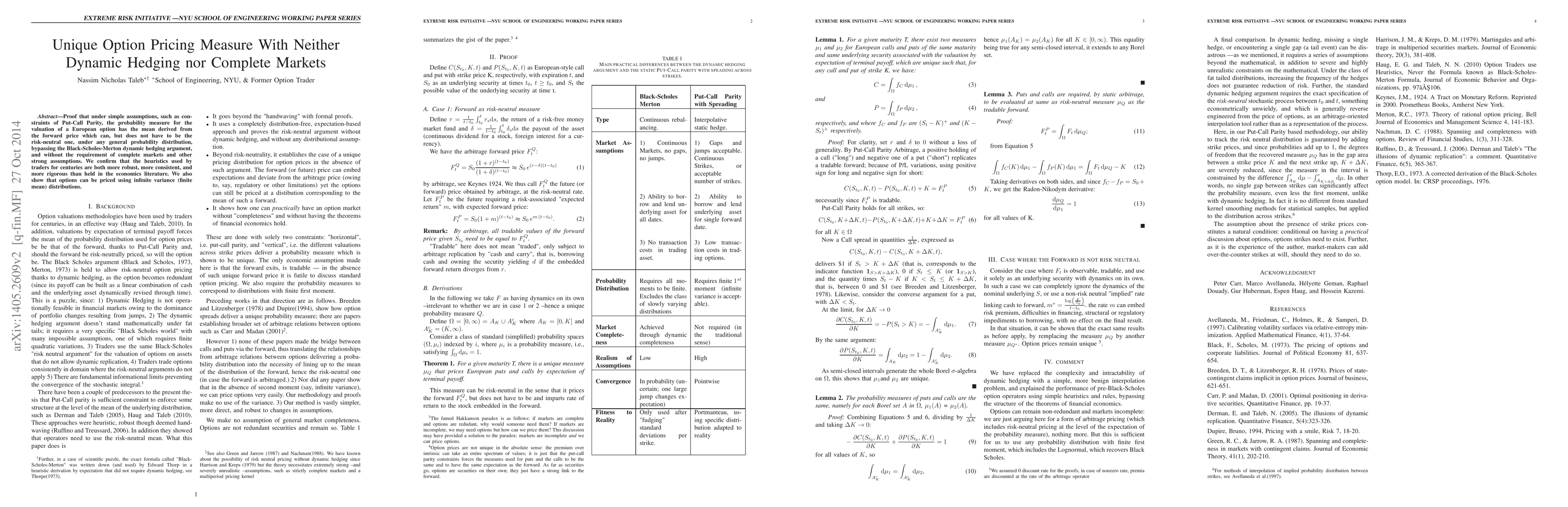

Proof that under simple assumptions, such as constraints of Put-Call Parity, the probability measure for the valuation of a European option has the mean derived from the forward price which can, but does not have to be the risk-neutral one, under any general probability distribution, bypassing the Black-Scholes-Merton dynamic hedging argument, and without the requirement of complete markets and other strong assumptions. We confirm that the heuristics used by traders for centuries are both more robust, more consistent, and more rigorous than held in the economics literature. We also show that options can be priced using infinite variance (finite mean) distributions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersESG-valued discrete option pricing in complete markets

W. Brent Lindquist, Svetlozar T. Rachev, Yuan Hu

| Title | Authors | Year | Actions |

|---|

Comments (0)