Summary

A risk-neutral valuation framework is developed for pricing and hedging in-play football bets based on modelling scores by independent Poisson processes with constant intensities. The Fundamental Theorems of Asset Pricing are applied to this set-up which enables us to derive novel arbitrage-free valuation formul\ae\ for contracts currently traded in the market. We also describe how to calibrate the model to the market and how trades can be replicated and hedged.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

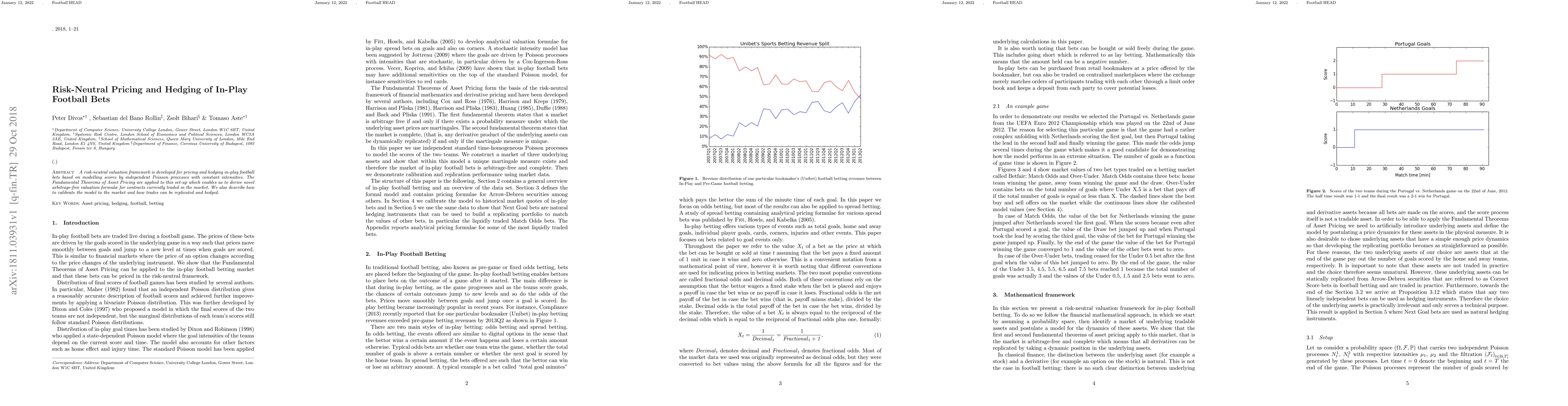

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHedging and Pricing Structured Products Featuring Multiple Underlying Assets

Anil Sharma, Freeman Chen, Jaesun Noh et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)