Authors

Summary

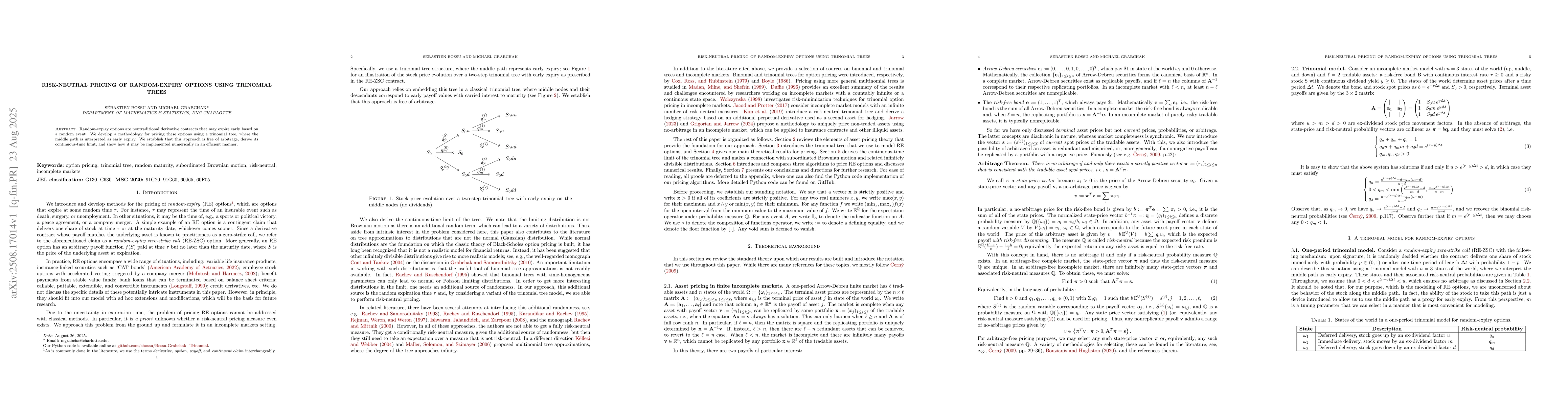

Random-expiry options are nontraditional derivative contracts that may expire early based on a random event. We develop a methodology for pricing these options using a trinomial tree, where the middle path is interpreted as early expiry. We establish that this approach is free of arbitrage, derive its continuous-time limit, and show how it may be implemented numerically in an efficient manner.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersPricing Bermudan options using regression trees/random forests

Jérôme Lelong, Pierre Henry-Labordere, Zineb El Filali Ech-Chafiq

Risk-neutral valuation of options under arithmetic Brownian motions

Qiang Liu, Yuhan Jiao, Shuxin Guo

Comments (0)