Authors

Summary

This study provides a practical introduction to high-frequency trading in blockchain-based currency markets. These types of markets have some specific characteristics that differentiate them from the stock markets, such as a large number of trading exchanges (centralized and decentralized), relative simplicity in moving funds from one exchange to another, and the large number of new currencies that have very little liquidity. This study analyzes the possible risks that specifically characterize this type of trading operation, the potential opportunities, and the algorithms that are mostly used, providing information that can be useful for practitioners who intend to operate in these markets by providing (and risking) liquidity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

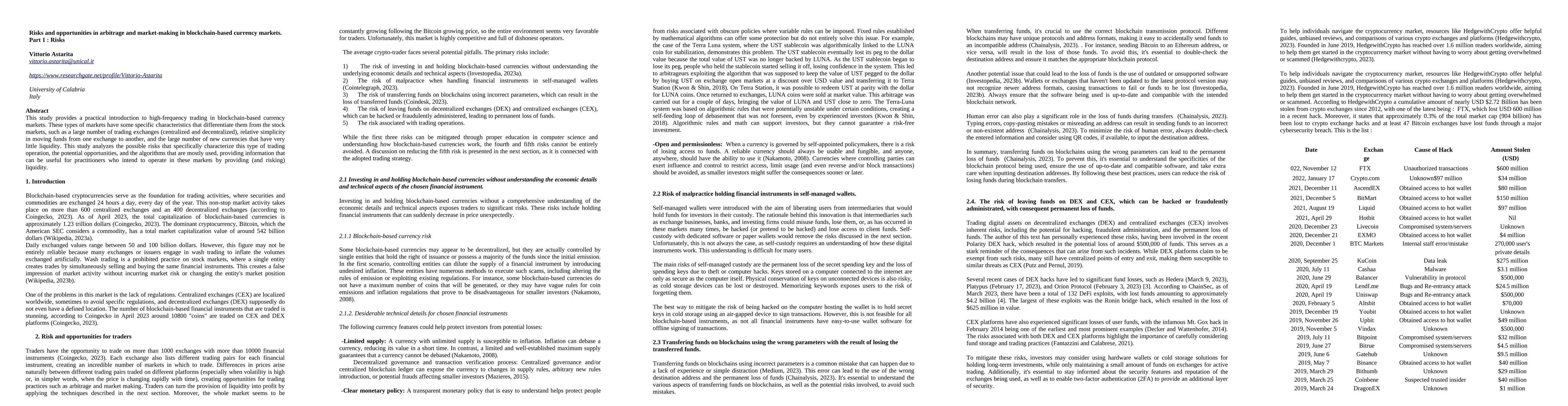

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnergy Storage Arbitrage Under Price Uncertainty: Market Risks and Opportunities

James Anderson, Bolun Xu, Yiqian Wu

Understanding and managing blockchain protocol risks

Alex Nathan, Dimosthenis Kaponis, Saul Lustgarten

No citations found for this paper.

Comments (0)