Summary

In this paper, we study robust covariance estimation under the approximate factor model with observed factors. We propose a novel framework to first estimate the initial joint covariance matrix of the observed data and the factors, and then use it to recover the covariance matrix of the observed data. We prove that once the initial matrix estimator is good enough to maintain the element-wise optimal rate, the whole procedure will generate an estimated covariance with desired properties. For data with only bounded fourth moments, we propose to use Huber loss minimization to give the initial joint covariance estimation. This approach is applicable to a much wider range of distributions, including sub-Gaussian and elliptical distributions. We also present an asymptotic result for Huber's M-estimator with a diverging parameter. The conclusions are demonstrated by extensive simulations and real data analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

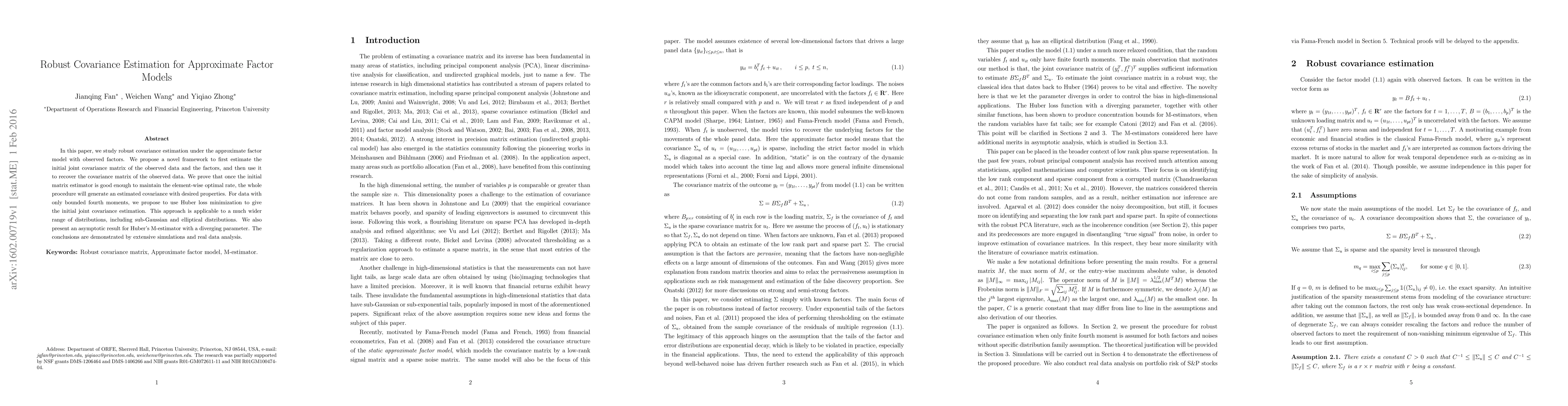

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)