Authors

Summary

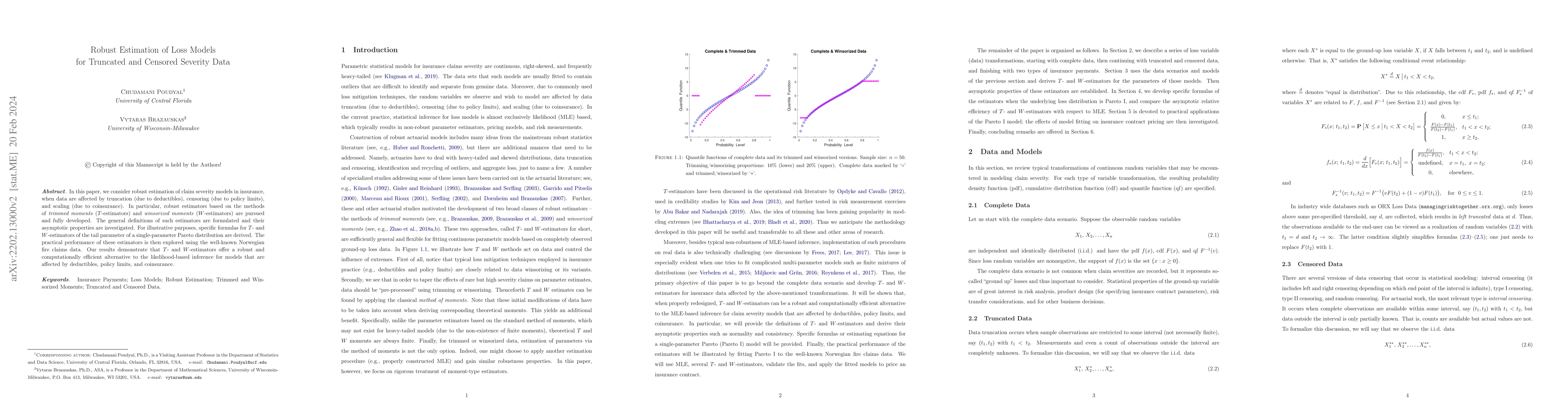

In this paper, we consider robust estimation of claim severity models in insurance, when data are affected by truncation (due to deductibles), censoring (due to policy limits), and scaling (due to coinsurance). In particular, robust estimators based on the methods of trimmed moments (T-estimators) and winsorized moments (W-estimators) are pursued and fully developed. The general definitions of such estimators are formulated and their asymptotic properties are investigated. For illustrative purposes, specific formulas for T- and W-estimators of the tail parameter of a single-parameter Pareto distribution are derived. The practical performance of these estimators is then explored using the well-known Norwegian fire claims data. Our results demonstrate that T- and W-estimators offer a robust and computationally efficient alternative to the likelihood-based inference for models that are affected by deductibles, policy limits, and coinsurance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEstimation of Spectral Risk Measure for Left Truncated and Right Censored Data

Rituparna Sen, Suparna Biswas

Model Uncertainty and Selection of Risk Models for Left-Truncated and Right-Censored Loss Data

Qian Zhao, Sahadeb Upretee, Daoping Yu

| Title | Authors | Year | Actions |

|---|

Comments (0)