Summary

We solve a min-max problem in a robust exploratory mean-variance problem with drift uncertainty in this paper. It is verified that robust investors choose the Sharpe ratio with minimal $L^2$ norm in an admissible set. A reinforcement learning framework in the mean-variance problem provides an exploration-exploitation trade-off mechanism; if we additionally consider model uncertainty, the robust strategy essentially weights more on exploitation rather than exploration and thus reflects a more conservative optimization scheme. Finally, we use financial data to backtest the performance of the robust exploratory investment and find that the robust strategy can outperform the purely exploratory strategy and resist the downside risk in a bear market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

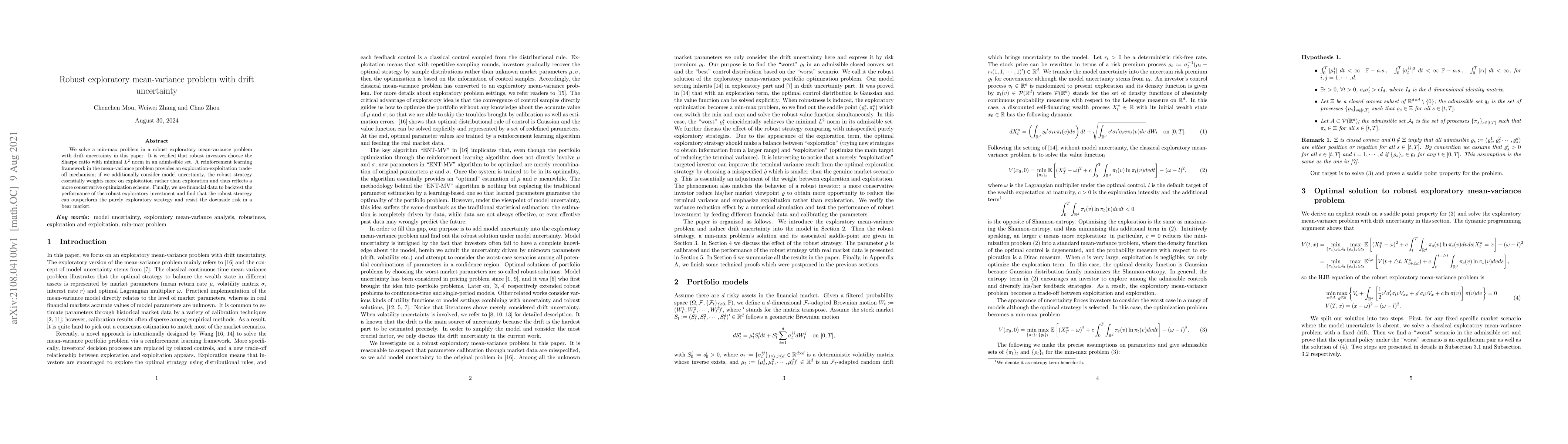

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExploratory mean-variance portfolio selection with Choquet regularizers

Hao Wang, Xia Han, Junyi Guo

Robust equilibrium strategy for mean-variance-skewness portfolio selection problem

Zhihao Hu, Nan-jing Huang, Jian-hao Kang et al.

A robust stochastic control problem with applications to monotone mean-variance problems

Yuyang Chen, Peng Luo, Tianjiao Hua

| Title | Authors | Year | Actions |

|---|

Comments (0)