Summary

We investigate asymmetry of information in the context of robust approach to pricing and hedging of financial derivatives. We consider two agents, one who only observes the stock prices and another with some additional information, and investigate when the pricing--hedging duality for the former extends to the latter. We introduce a general framework to express the superhedging and market model prices for an informed agent. Our key insight is that an informed agent can be seen as a regular agent who can restrict her attention to a certain subset of possible paths. We use results of Hou & Ob\l\'oj on robust approach with beliefs to establish the pricing--hedging duality for an informed agent. Our results cover number of scenarios, including information arriving before trading starts, arriving after static position in European options is formed but before dynamic trading starts or arriving at some point before the maturity. For the latter we show that the superhedging value satisfies a suitable dynamic programming principle, which is of independent interest.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

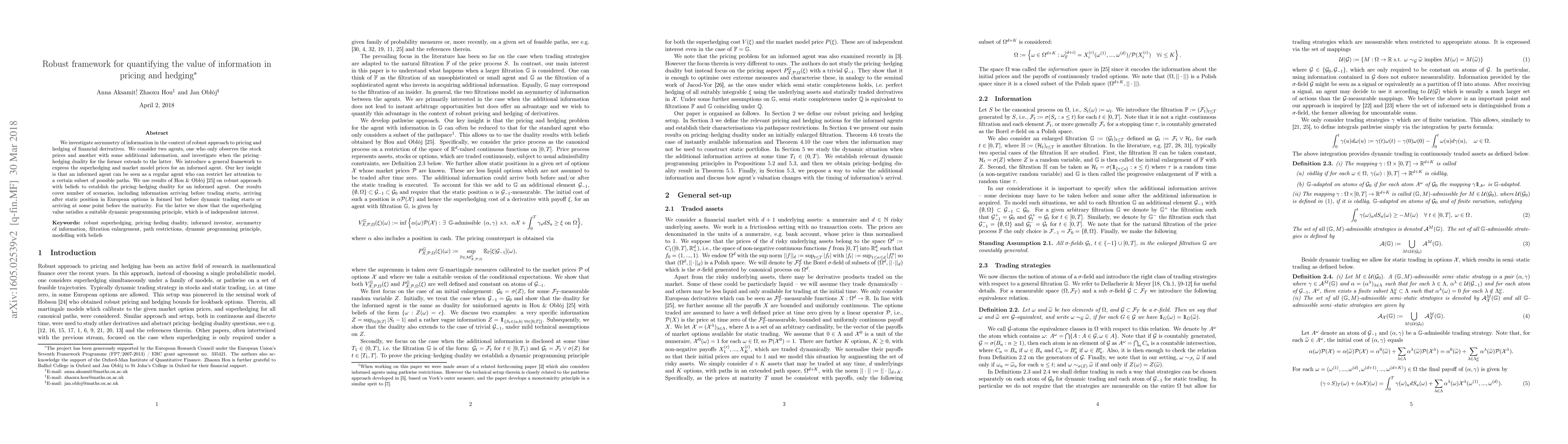

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust Pricing and Hedging of American Options in Continuous Time

Ivan Guo, Jan Obłój

| Title | Authors | Year | Actions |

|---|

Comments (0)