Authors

Summary

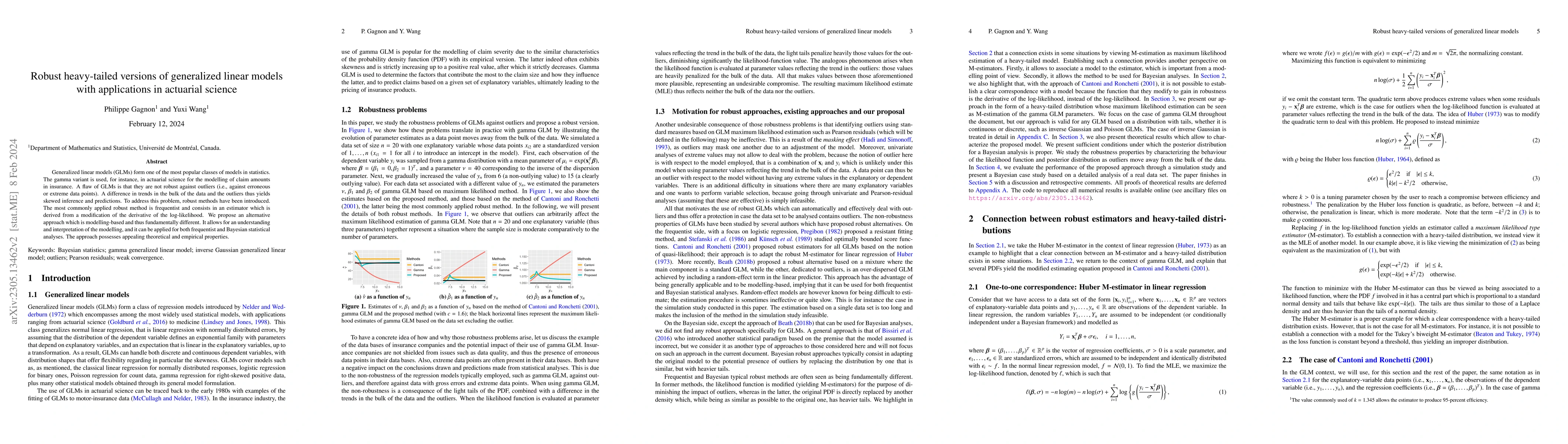

Generalized linear models (GLMs) form one of the most popular classes of models in statistics. The gamma variant is used, for instance, in actuarial science for the modelling of claim amounts in insurance. A flaw of GLMs is that they are not robust against outliers (i.e., against erroneous or extreme data points). A difference in trends in the bulk of the data and the outliers thus yields skewed inference and predictions. To address this problem, robust methods have been introduced. The most commonly applied robust method is frequentist and consists in an estimator which is derived from a modification of the derivative of the log-likelihood. We propose an alternative approach which is modelling-based and thus fundamentally different. It allows for an understanding and interpretation of the modelling, and it can be applied for both frequentist and Bayesian statistical analyses. The approach possesses appealing theoretical and empirical properties.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEfficient Algorithms for Generalized Linear Bandits with Heavy-tailed Rewards

Lijun Zhang, Jinfeng Yi, Yuanyu Wan et al.

Robust Offline Reinforcement learning with Heavy-Tailed Rewards

Shikai Luo, Chengchun Shi, Zhengling Qi et al.

Provably Robust Temporal Difference Learning for Heavy-Tailed Rewards

Semih Cayci, Atilla Eryilmaz

| Title | Authors | Year | Actions |

|---|

Comments (0)