Summary

Large-scale multiple testing under static factor models is commonly used to select skilled funds in financial market. However, static factor models are arguably too stringent as it ignores the serial correlation, which severely distorts error rate control in large-scale inference. In this manuscript, we propose a new multiple testing procedure under dynamic factor models that is robust against both heavy-tailed distributions and the serial dependence. The idea is to integrate a new sample-splitting strategy based on chronological order and a two-pass Fama-Macbeth regression to form a series of statistics with marginal symmetry properties and then to utilize the symmetry properties to obtain a data-driven threshold. We show that our procedure is able to control the false discovery rate (FDR) asymptotically under high-dimensional dynamic factor models. As a byproduct that is of independent interest, we establish a new exponential-type deviation inequality for the sum of random variables on a variety of functionals of linear and non-linear processes. Numerical results including a case study on hedge fund selection demonstrate the advantage of the proposed method over several state-of-the-art methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

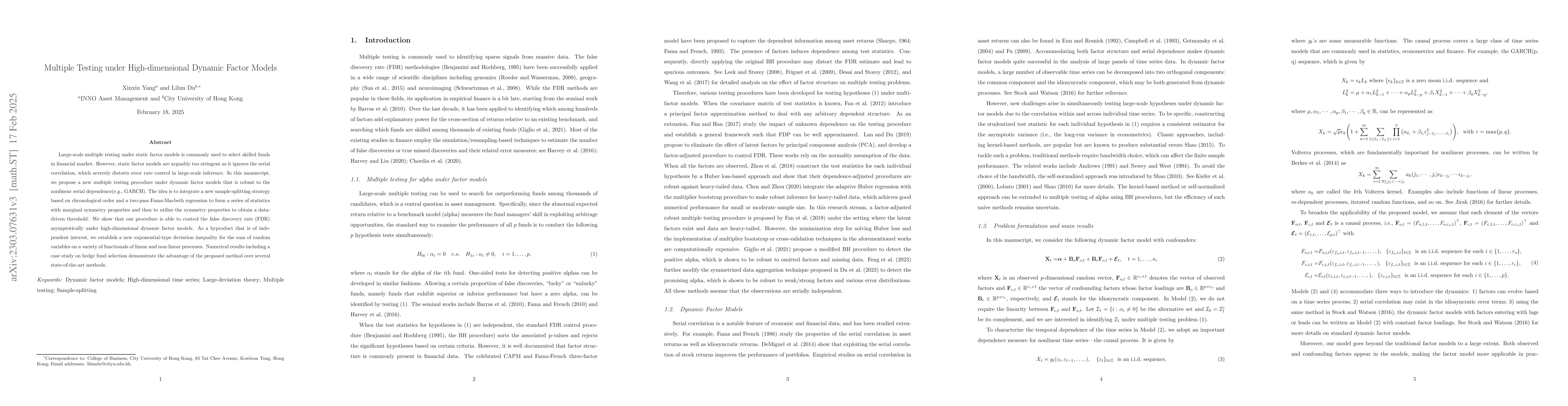

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust High-dimensional Tuning Free Multiple Testing

Jianqing Fan, Mengxin Yu, Zhipeng Lou

Adaptive adequacy testing of high-dimensional factor-augmented regression model

Xu Guo, Leheng Cai, Shurong Zheng et al.

No citations found for this paper.

Comments (0)