Summary

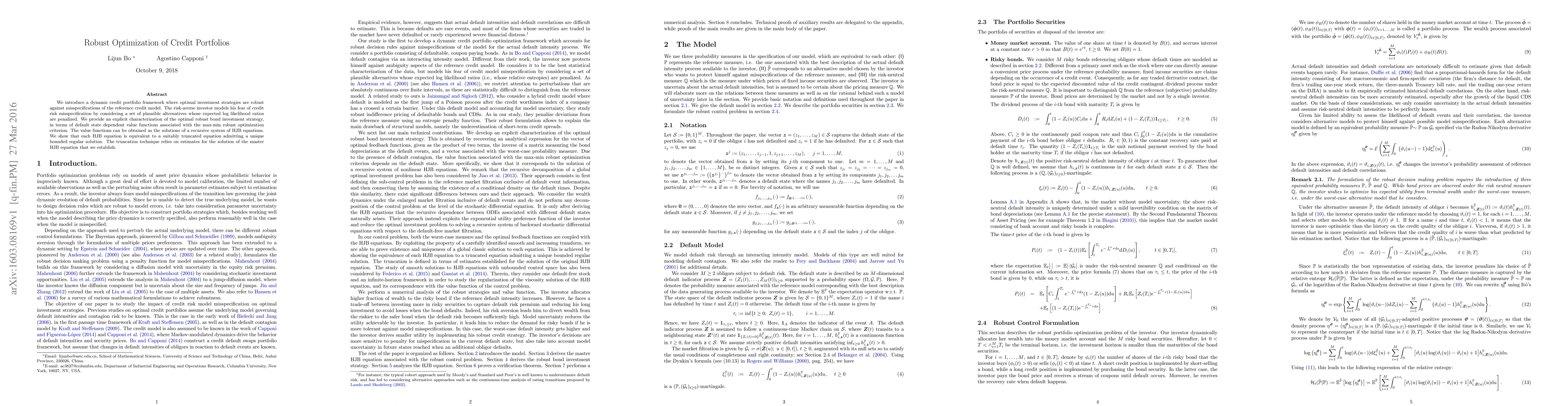

We introduce a dynamic credit portfolio framework where optimal investment strategies are robust against misspecifications of the reference credit model. The risk-averse investor models his fear of credit risk misspecification by considering a set of plausible alternatives whose expected log likelihood ratios are penalized. We provide an explicit characterization of the optimal robust bond investment strategy, in terms of default state dependent value functions associated with the max-min robust optimization criterion. The value functions can be obtained as the solutions of a recursive system of HJB equations. We show that each HJB equation is equivalent to a suitably truncated equation admitting a unique bounded regular solution. The truncation technique relies on estimates for the solution of the master HJB equation that we establish.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)