Summary

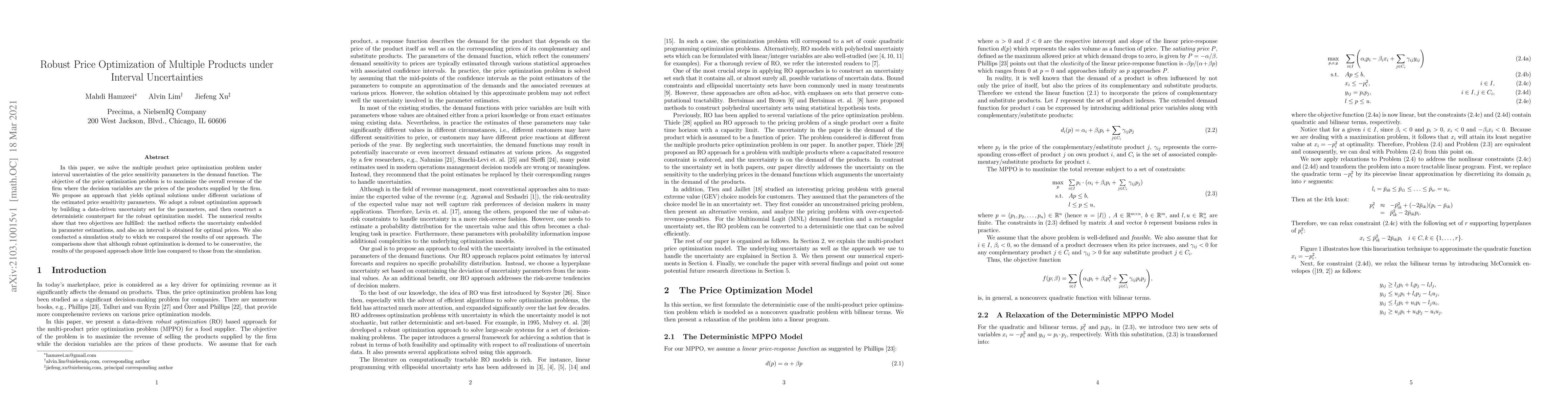

In this paper, we solve the multiple product price optimization problem under interval uncertainties of the price sensitivity parameters in the demand function. The objective of the price optimization problem is to maximize the overall revenue of the firm where the decision variables are the prices of the products supplied by the firm. We propose an approach that yields optimal solutions under different variations of the estimated price sensitivity parameters. We adopt a robust optimization approach by building a data-driven uncertainty set for the parameters, and then construct a deterministic counterpart for the robust optimization model. The numerical results show that two objectives are fulfilled: the method reflects the uncertainty embedded in parameter estimations, and also an interval is obtained for optimal prices. We also conducted a simulation study to which we compared the results of our approach. The comparisons show that although robust optimization is deemed to be conservative, the results of the proposed approach show little loss compared to those from the simulation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinite Strain Robust Topology Optimization Considering Multiple Uncertainties

Nan Feng, Guodong Zhang, Kapil Khandelwal

Price and Assortment Optimization under the Multinomial Logit Model with Opaque Products

Jiaqi Shi, Omar El Housni, Adam N. Elmachtoub et al.

Trajectory Optimization under Contact Timing Uncertainties

Majid Khadiv, Haizhou Zhao

| Title | Authors | Year | Actions |

|---|

Comments (0)