Authors

Summary

We show how to price and replicate a variety of barrier-style claims written on the $\log$ price $X$ and quadratic variation $\langle X \rangle$ of a risky asset. Our framework assumes no arbitrage, frictionless markets and zero interest rates. We model the risky asset as a strictly positive continuous semimartingale with an independent volatility process. The volatility process may exhibit jumps and may be non-Markovian. As hedging instruments, we use only the underlying risky asset, zero-coupon bonds, and European calls and puts with the same maturity as the barrier-style claim. We consider knock-in, knock-out and rebate claims in single and double barrier varieties.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper presents a framework for pricing and replicating barrier-style claims on the log price and quadratic variation of a risky asset, assuming no arbitrage, frictionless markets, and zero interest rates. The risky asset is modeled as a strictly positive continuous semimartingale with an independent volatility process that can exhibit jumps and be non-Markovian.

Key Results

- The paper derives pricing and replication strategies for knock-in, knock-out, and rebate claims in single and double barrier varieties using only the underlying risky asset, zero-coupon bonds, and European calls and puts with the same maturity as the barrier-style claim.

- A robust replication formula is provided for a variety of barrier-style claims, which does not specify the dynamics of the volatility process, allowing for non-Markovian and jump-diffusion processes.

- The paper extends previous work by Carr and Lee (2008) to include claims that pay based on the quadratic variation of the log price.

Significance

This research is significant as it provides a comprehensive framework for pricing and replicating complex barrier options, which are widely used in financial markets. The methodology's flexibility in accommodating non-Markovian and jump-diffusion volatility processes enhances its applicability and practical relevance.

Technical Contribution

The paper's main technical contribution is the development of a robust replication formula for a wide range of barrier-style claims, including those dependent on quadratic variation, without specifying the dynamics of the underlying volatility process.

Novelty

The novelty of this work lies in its ability to handle non-Markovian and jump-diffusion volatility processes, extending the applicability of barrier option pricing and replication beyond Markovian models, while also incorporating claims based on quadratic variation.

Limitations

- The model assumes zero interest rates, which may limit its applicability in markets with positive interest rates.

- The framework does not account for transaction costs or market frictions that could affect real-world implementation of the replication strategies.

Future Work

- Investigate the impact of transaction costs and market frictions on the replication strategies.

- Explore extensions of the model to include stochastic interest rates and more general underlying asset dynamics.

Paper Details

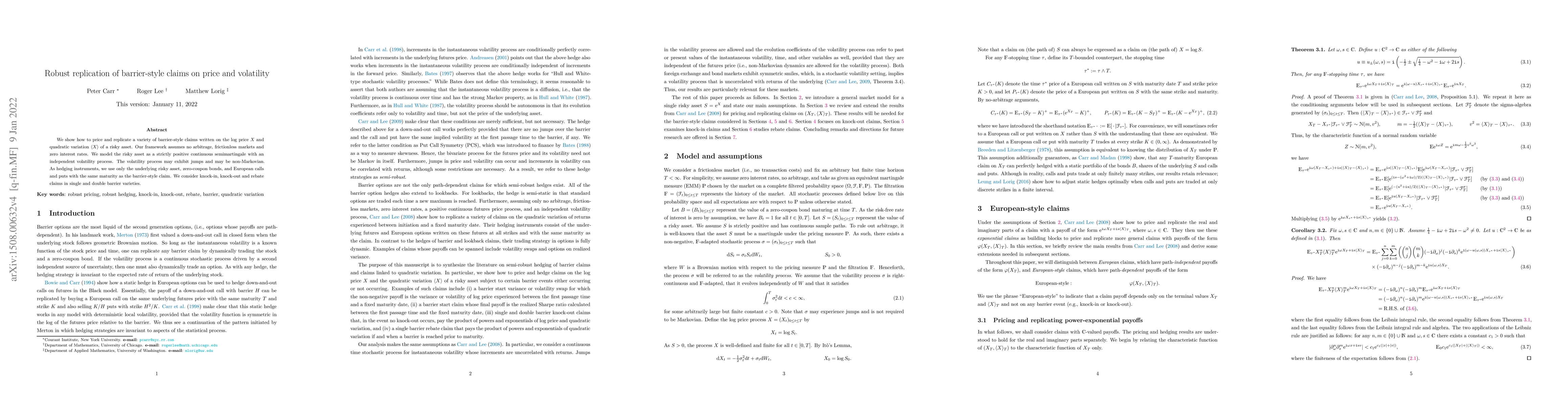

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)