Summary

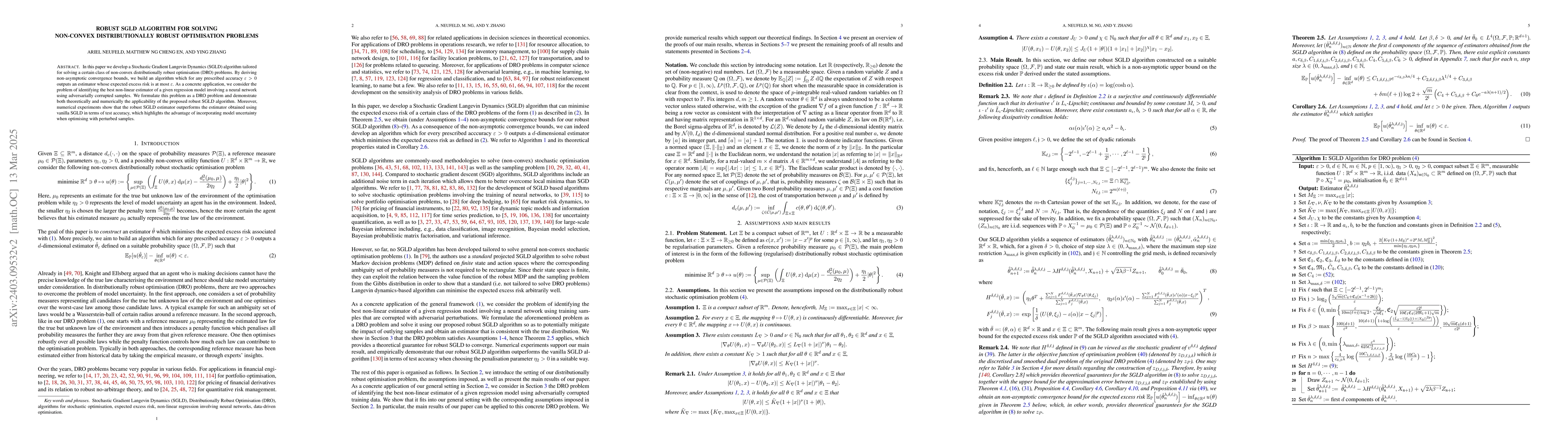

In this paper we develop a Stochastic Gradient Langevin Dynamics (SGLD) algorithm tailored for solving a certain class of non-convex distributionally robust optimisation problems. By deriving non-asymptotic convergence bounds, we build an algorithm which for any prescribed accuracy $\varepsilon>0$ outputs an estimator whose expected excess risk is at most $\varepsilon$. As a concrete application, we employ our robust SGLD algorithm to solve the (regularised) distributionally robust Mean-CVaR portfolio optimisation problem using real financial data. We empirically demonstrate that the trading strategy obtained by our robust SGLD algorithm outperforms the trading strategy obtained when solving the corresponding non-robust Mean-CVaR portfolio optimisation problem using, e.g., a classical SGLD algorithm. This highlights the practical relevance of incorporating model uncertainty when optimising portfolios in real financial markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGlobal and Robust Optimisation for Non-Convex Quadratic Programs

Vassilis M. Charitopoulos, Asimina Marousi

Large-Scale Non-convex Stochastic Constrained Distributionally Robust Optimization

Lixin Shen, Qi Zhang, Yi Zhou et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)