Summary

The paper studies the robust maximization of utility of terminal wealth in the diffusion financial market model. The underlying model consists with risky tradable asset, whose price is described by diffusion process with misspecified trend and volatility coefficients, and non-tradable asset with a known parameter. The robust utility functional is defined in terms of a HARA utility function. We give explicit characterization of the solution of the problem by means of a solution of the HJBI equation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

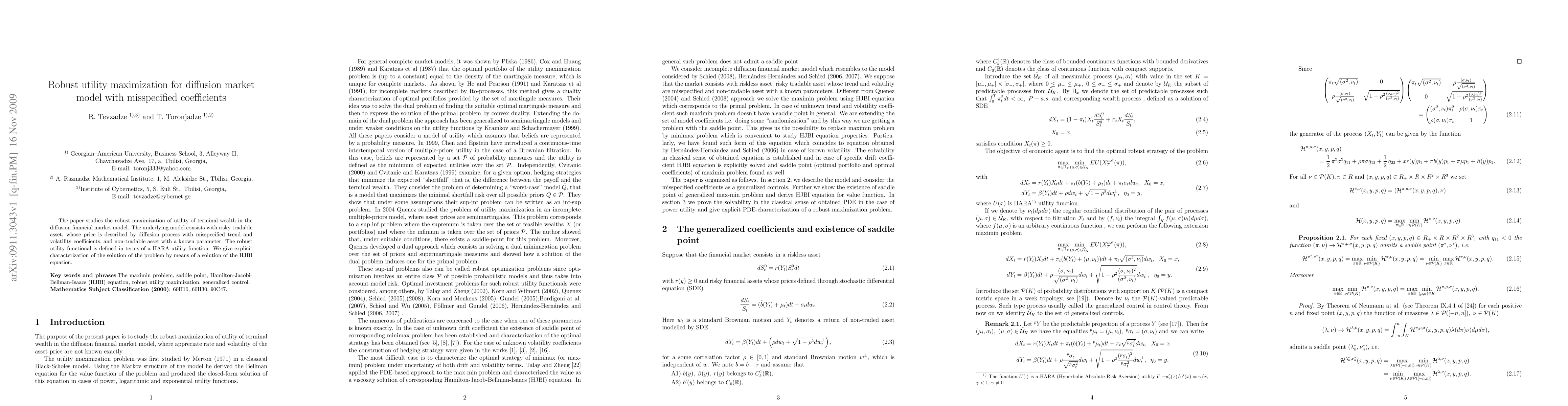

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust utility maximization with intractable claims

Xun Yu Zhou, Zuo Quan Xu, Yunhong Li

| Title | Authors | Year | Actions |

|---|

Comments (0)