Authors

Summary

We study a utility maximization problem in a financial market with a stochastic drift process, combining a worst-case approach with filtering techniques. Drift processes are difficult to estimate from asset prices, and at the same time optimal strategies in portfolio optimization problems depend crucially on the drift. We approach this problem by setting up a worst-case optimization problem with a time-dependent uncertainty set for the drift. Investors assume that the worst possible drift process with values in the uncertainty set will occur. This leads to local optimization problems, and the resulting optimal strategy needs to be updated continuously in time. We prove a minimax theorem for the local optimization problems and derive the optimal strategy. Further, we show how an ellipsoidal uncertainty set can be defined based on filtering techniques and demonstrate that investors need to choose a robust strategy to be able to profit from additional information.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

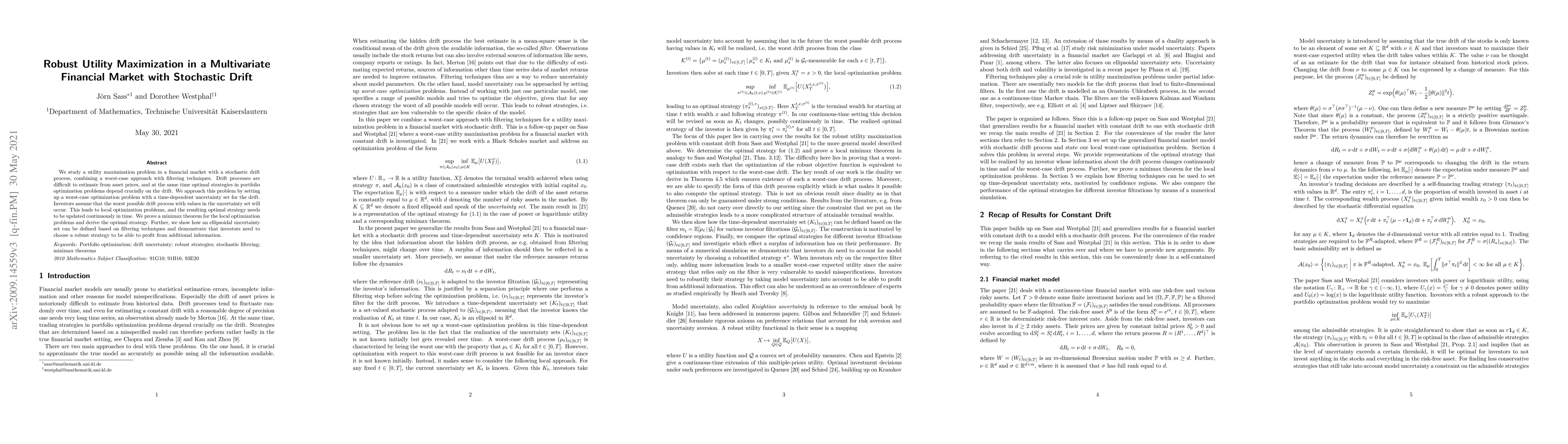

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWell Posedness of Utility Maximization Problems Under Partial Information in a Market with Gaussian Drift

Abdelali Gabih, Ralf Wunderlich, Hakam Kondakji

| Title | Authors | Year | Actions |

|---|

Comments (0)