Summary

We formulate conditions for the solvability of the problem of robust utility maximization from final wealth in continuous time financial markets, without assuming weak compactness of the densities of the uncertainty set, as customary in the literature. Relevant examples of such a situation typically arise when the uncertainty set is determined through moment constraints. Our approach is based on identifying functional spaces naturally associated with the elements of each problem. For general markets these are modular spaces, through which we can prove a minimax equality and the existence of optimal strategies by exploiting the compactness, which we establish, of the image by the utility function of the set of attainable wealths. In complete markets we obtain additionally the existence of a worst-case measure, and combining our ideas with abstract entropy minimization techniques, we moreover provide in that case a novel methodology for the characterization of such measures.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

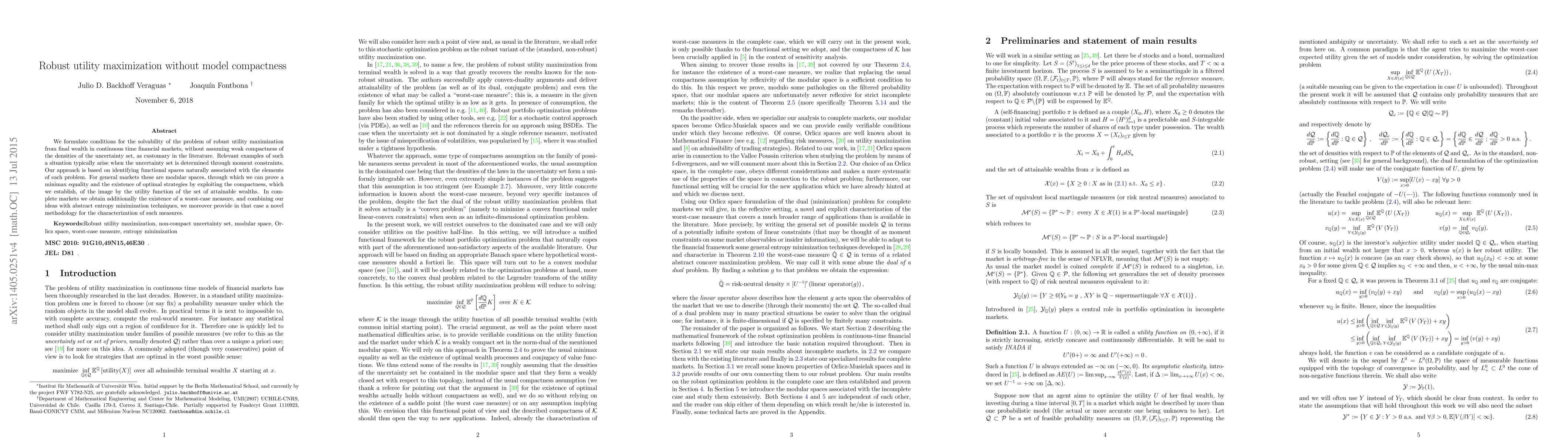

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust utility maximization with nonlinear continuous semimartingales

David Criens, Lars Niemann

Robust utility maximization with intractable claims

Xun Yu Zhou, Zuo Quan Xu, Yunhong Li

| Title | Authors | Year | Actions |

|---|

Comments (0)