Authors

Summary

In this paper we show that Hilbert space-valued stochastic models are robust with respect to perturbation, due to measurement or approximation errors, in the underlying volatility process. Within the class of stochastic volatility modulated Ornstein-Uhlenbeck processes, we quantify the error induced by the volatility in terms of perturbations in the parameters of the volatility process. We moreover study the robustness of the volatility process itself with respect to finite dimensional approximations of the driving compound Poisson process and semigroup generator respectively, when considering operator-valued Barndorff-Nielsen and Shephard stochastic volatility models. We also give results on square root approximations. In all cases we provide explicit bounds for the induced error in terms of the approximation of the underlying parameter. We discuss some applications to robustness of prices of options on forwards and volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

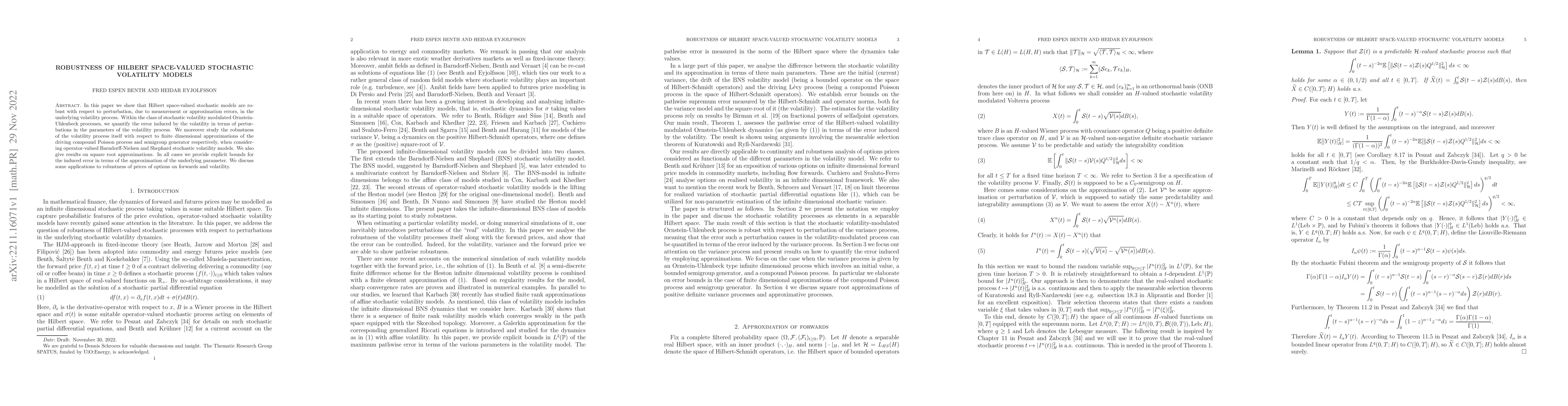

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Reproducing Kernel Hilbert Space approach to singular local stochastic volatility McKean-Vlasov models

Denis Belomestny, John Schoenmakers, Oleg Butkovsky et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)