Authors

Summary

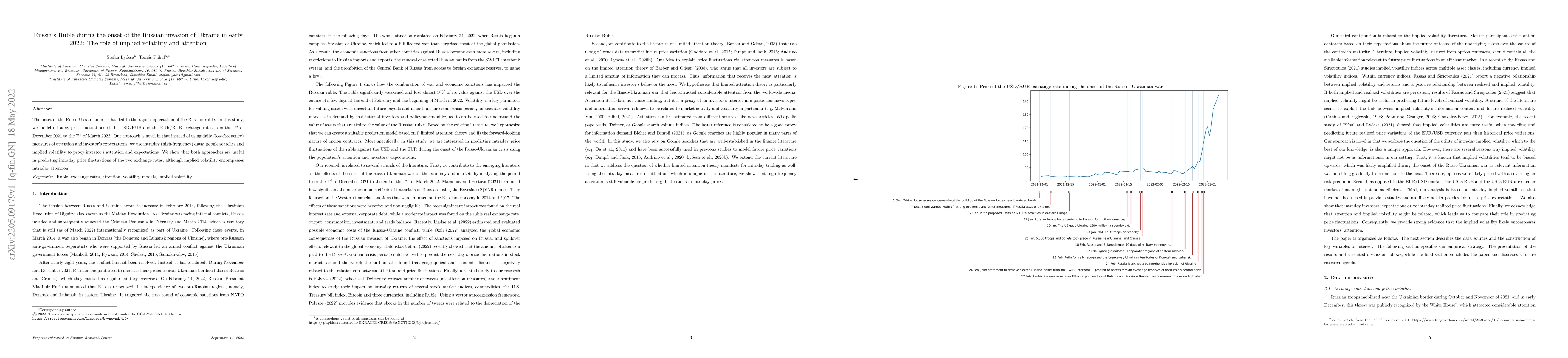

The onset of the Russo-Ukrainian crisis has led to the rapid depreciation of the Russian ruble. In this study, we model intraday price fluctuations of the USD/RUB and the EUR/RUB exchange rates from the $1^{st}$ of December 2021 to the $7^{th}$ of March 2022. Our approach is novel in that instead of using daily (low-frequency) measures of attention and investor's expectations, we use intraday (high-frequency) data: google searches and implied volatility to proxy investor's attention and expectations. We show that both approaches are useful in predicting intraday price fluctuations of the two exchange rates, although implied volatility encompasses intraday attention.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe role of investor attention in global asset price variation during the invasion of Ukraine

Martina Halousková, Daniel Stašek, Matúš Horváth

Russian propaganda on social media during the 2022 invasion of Ukraine

Stefan Feuerriegel, Dominik Bär, Nicolas Pröllochs et al.

"Please help share!": Security and Privacy Advice on Twitter during the 2022 Russian Invasion of Ukraine

Juliane Schmüser, Sascha Fahl, Yasemin Acar et al.

The Adaptive Strategies of Anti-Kremlin Digital Dissent in Telegram during the Russian Invasion of Ukraine

Valerie L. Shalin, Ugur Kursuncu, Dilshod Achilov et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)