Summary

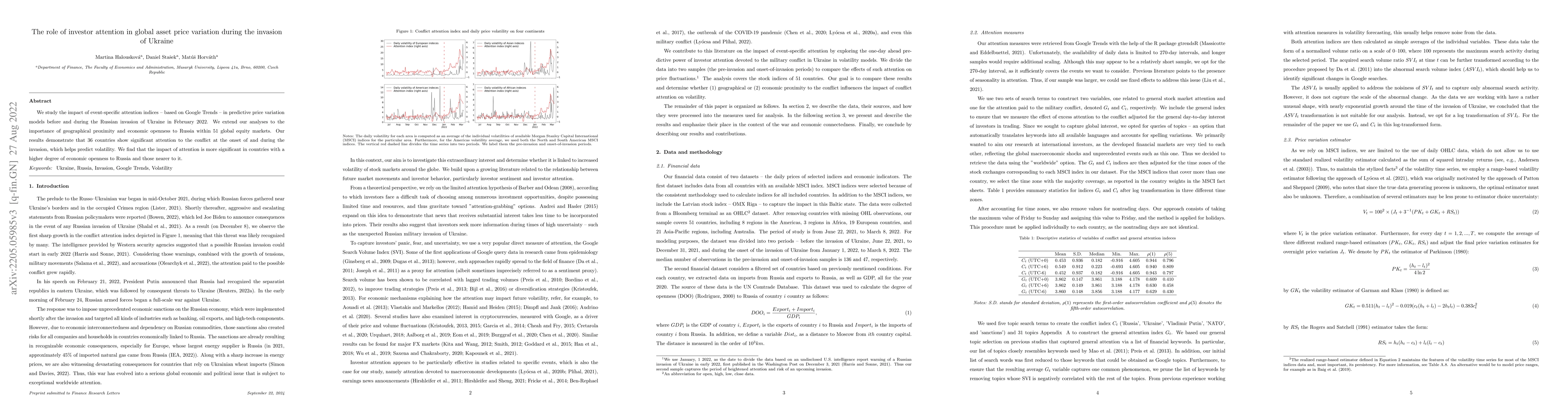

We study the impact of event-specific attention indices -- based on Google Trends -- in predictive price variation models before and during the Russian invasion of Ukraine in February 2022. We extend our analyses to the importance of geographical proximity and economic openness to Russia within 51 global equity markets. Our results demonstrate that 36 countries show significant attention to the conflict at the onset of and during the invasion, which helps predict volatility. We find that the impact of attention is more significant in countries with a higher degree of economic openness to Russia and those nearer to it.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Dynamics of Political Narratives During the Russian Invasion of Ukraine

Yu-Ru Lin, Ahana Biswas, Tim Niven

Russia's Ruble during the onset of the Russian invasion of Ukraine in early 2022: The role of implied volatility and attention

Štefan Lyócsa, Tomáš Plíhal

Russian propaganda on social media during the 2022 invasion of Ukraine

Stefan Feuerriegel, Dominik Bär, Nicolas Pröllochs et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)