Authors

Summary

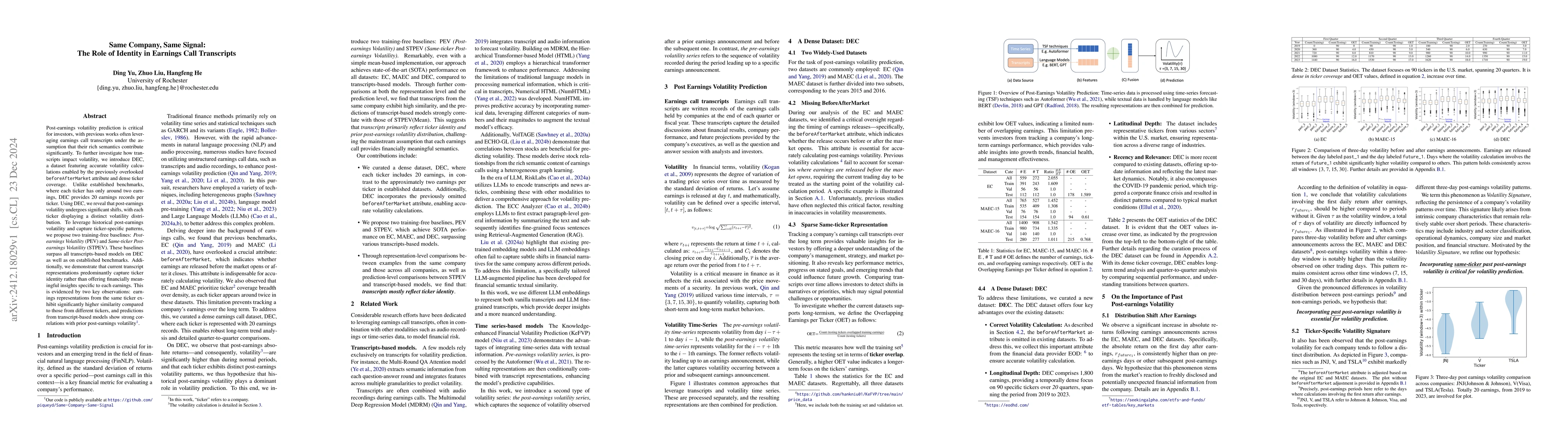

Post-earnings volatility prediction is critical for investors, with previous works often leveraging earnings call transcripts under the assumption that their rich semantics contribute significantly. To further investigate how transcripts impact volatility, we introduce DEC, a dataset featuring accurate volatility calculations enabled by the previously overlooked beforeAfterMarket attribute and dense ticker coverage. Unlike established benchmarks, where each ticker has only around two earnings, DEC provides 20 earnings records per ticker. Using DEC, we reveal that post-earnings volatility undergoes significant shifts, with each ticker displaying a distinct volatility distribution. To leverage historical post-earnings volatility and capture ticker-specific patterns, we propose two training-free baselines: Post-earnings Volatility (PEV) and Same-ticker Post-earnings Volatility (STPEV). These baselines surpass all transcripts-based models on DEC as well as on established benchmarks. Additionally, we demonstrate that current transcript representations predominantly capture ticker identity rather than offering financially meaningful insights specific to each earnings. This is evidenced by two key observations: earnings representations from the same ticker exhibit significantly higher similarity compared to those from different tickers, and predictions from transcript-based models show strong correlations with prior post-earnings volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAdvanced Deep Learning Techniques for Analyzing Earnings Call Transcripts: Methodologies and Applications

Umair Zakir, Evan Daykin, Amssatou Diagne et al.

SubjECTive-QA: Measuring Subjectivity in Earnings Call Transcripts' QA Through Six-Dimensional Feature Analysis

Agam Shah, Sudheer Chava, Huzaifa Pardawala et al.

No citations found for this paper.

Comments (0)