Summary

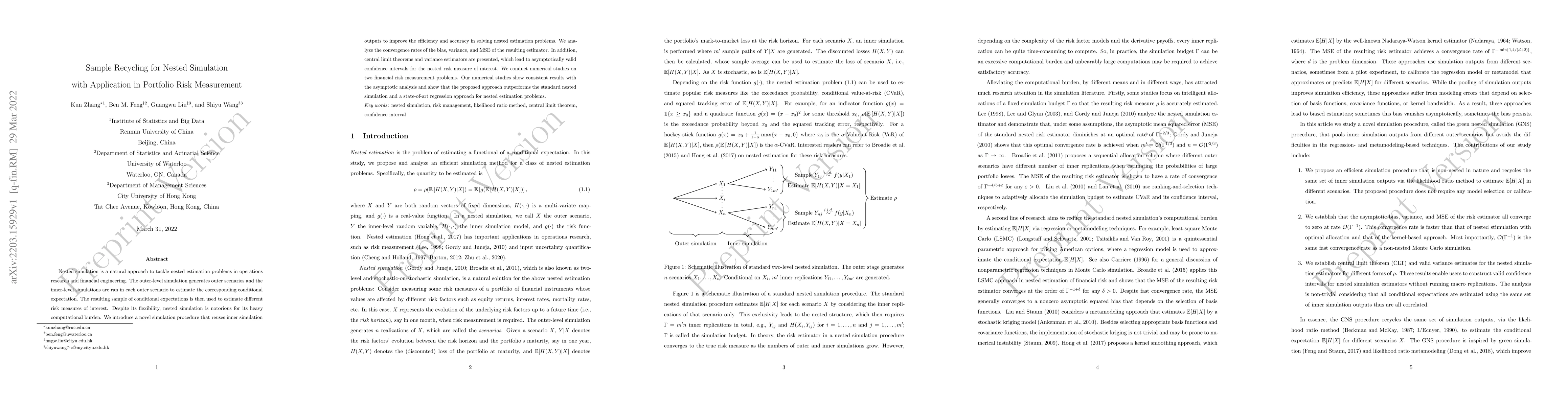

Nested simulation is a natural approach to tackle nested estimation problems in operations research and financial engineering. The outer-level simulation generates outer scenarios and the inner-level simulations are run in each outer scenario to estimate the corresponding conditional expectation. The resulting sample of conditional expectations is then used to estimate different risk measures of interest. Despite its flexibility, nested simulation is notorious for its heavy computational burden. We introduce a novel simulation procedure that reuses inner simulation outputs to improve efficiency and accuracy in solving nested estimation problems. We analyze the convergence rates of the bias, variance, and MSE of the resulting estimator. In addition, central limit theorems and variance estimators are presented, which lead to asymptotically valid confidence intervals for the nested risk measure of interest. We conduct numerical studies on two financial risk measurement problems. Our numerical studies show consistent results with the asymptotic analysis and show that the proposed approach outperforms the standard nested simulation and a state-of-art regression approach for nested estimation problems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)