Summary

We consider stochastic volatility dynamics driven by a general H\"older continuous Volterra-type noise and with unbounded drift. For such models, we consider the explicit computation of quadratic hedging strategies. While the theoretical solution is well-known in terms of the non-anticipating derivative for all square integrable claims, the fact that these models are typically non-Markovian provides a concrete difficulty in the direct computation of conditional expectations at the core of the explicit hedging strategy. To overcome this difficulty, we propose a Markovian approximation of the model which stems from an adequate approximation of the kernel in the Volterra noise. We study the approximation of the volatility, the prices as well as the optimal mean-square hedge and provide the corresponding error estimates. We complete the work with numerical simulations performed with different methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

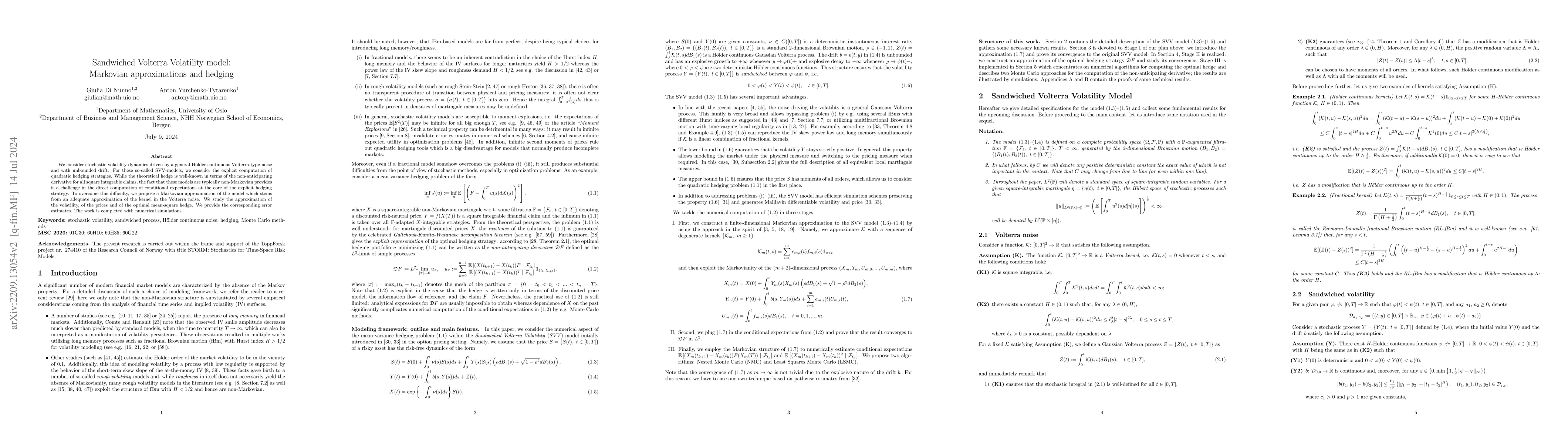

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPower law in Sandwiched Volterra Volatility model

Giulia Di Nunno, Anton Yurchenko-Tytarenko

Option pricing in Sandwiched Volterra Volatility model

Giulia Di Nunno, Yuliya Mishura, Anton Yurchenko-Tytarenko

Markovian approximations of stochastic Volterra equations with the fractional kernel

Christian Bayer, Simon Breneis

| Title | Authors | Year | Actions |

|---|

Comments (0)