Authors

Summary

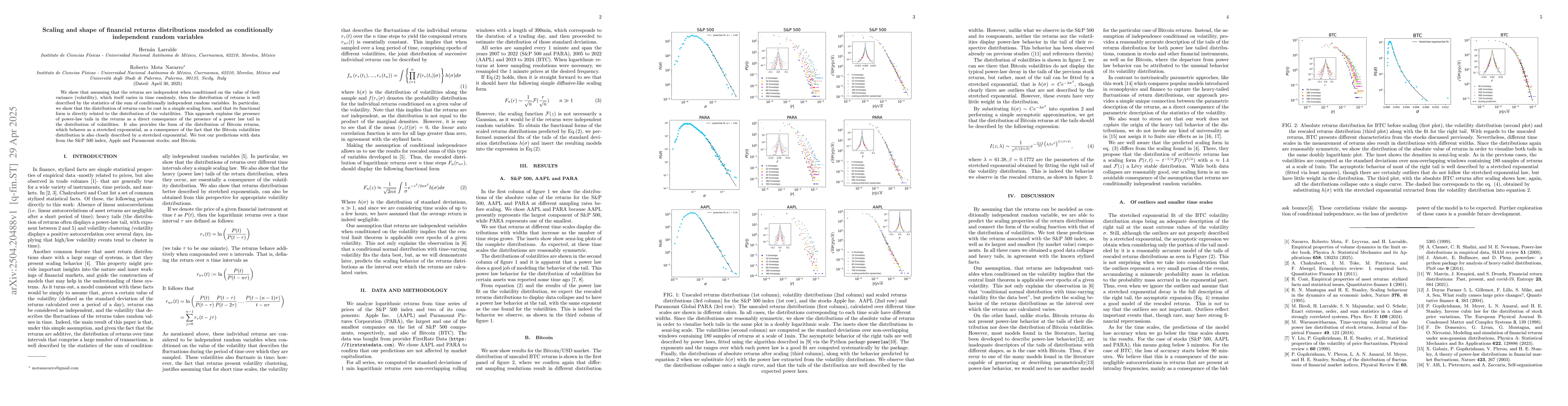

We show that assuming that the returns are independent when conditioned on the value of their variance (volatility), which itself varies in time randomly, then the distribution of returns is well described by the statistics of the sum of conditionally independent random variables. In particular, we show that the distribution of returns can be cast in a simple scaling form, and that its functional form is directly related to the distribution of the volatilities. This approach explains the presence of power-law tails in the returns as a direct consequence of the presence of a power law tail in the distribution of volatilities. It also provides the form of the distribution of Bitcoin returns, which behaves as a stretched exponential, as a consequence of the fact that the Bitcoin volatilities distribution is also closely described by a stretched exponential. We test our predictions with data from the S\&P 500 index, Apple and Paramount stocks; and Bitcoin.

AI Key Findings

Generated Jun 08, 2025

Methodology

The research models financial returns as conditionally independent random variables, with variance (volatility) varying randomly over time. It demonstrates that the distribution of returns can be described by the statistics of the sum of these conditionally independent variables, leading to a simple scaling form.

Key Results

- The distribution of returns exhibits power-law tails, explained by the presence of power-law tails in the distribution of volatilities.

- The form of Bitcoin returns distribution is identified as a stretched exponential due to closely matching stretched exponential volatilities distribution.

- Predictions are validated using data from S&P 500 index, Apple and Paramount stocks, and Bitcoin.

Significance

This research provides a novel explanation for power-law tails in financial returns distributions, bridging the connection between return and volatility distributions, and offering a new model for Bitcoin returns.

Technical Contribution

The paper presents a new approach to modeling financial returns distributions, emphasizing conditional independence on volatility and its implications for return tail behavior.

Novelty

This work distinguishes itself by linking power-law tails in returns directly to those in volatility distributions, providing a specific form for Bitcoin returns, and validating the model with empirical data.

Limitations

- The study is limited to the assumption of conditional independence of returns given volatility, which may not always hold in real financial markets.

- Validation is based on specific stock indices and companies, limiting the generalizability of findings to all financial markets.

Future Work

- Further investigation into the applicability of this model across diverse financial markets and asset classes.

- Exploration of alternative models to assess the robustness of the findings.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMalliavin structure for conditionally independent random variables

Laurent Decreusefond, Christophe Vuong

The saddlepoint approximation for averages of conditionally independent random variables

Ziang Niu, Eugene Katsevich, Jyotishka Ray Choudhury

No citations found for this paper.

Comments (0)