Summary

We derive scaling limits for integral functionals of It\^o processes with fast nonlinear mean-reversion speed. We show that in these limits, the fast mean-reverting process is "averaged out" by integrating against its invariant measure. These convergence results hold uniformly in probability and, under mild integrability conditions, also in $\mathcal{S}^p$. They are a crucial building block for the analysis of portfolio choice models with small superlinear transaction costs, carried out in the companion paper of the present study.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

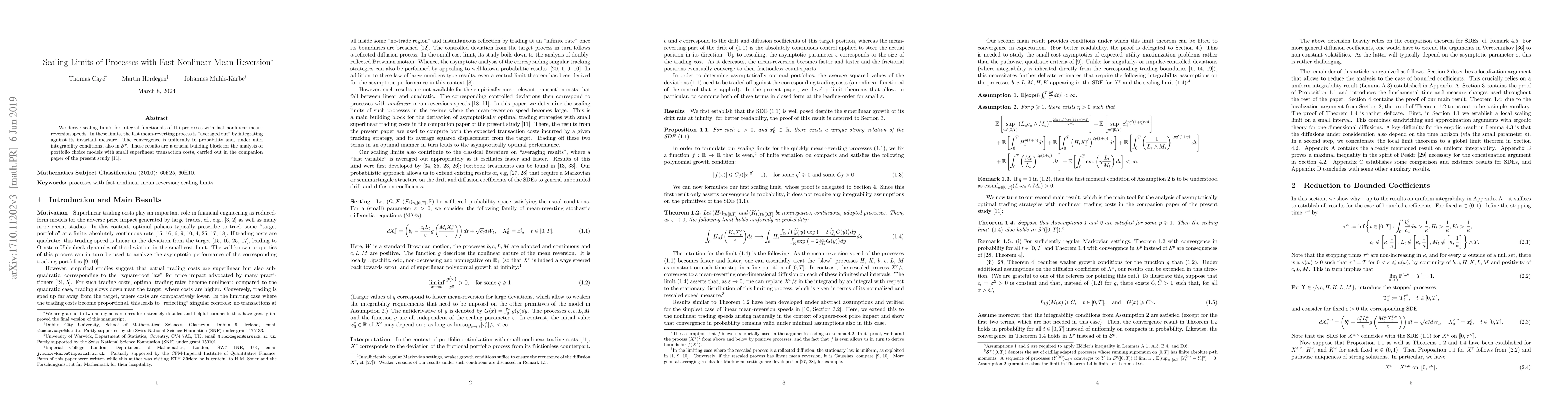

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)