Authors

Summary

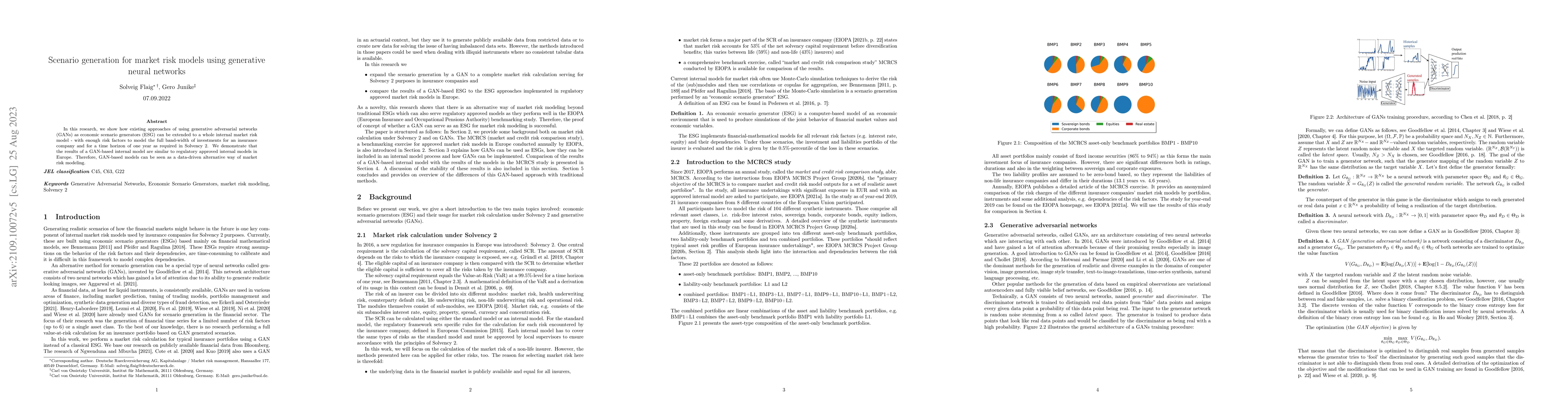

In this research, we show how to expand existing approaches of using generative adversarial networks (GANs) as economic scenario generators (ESG) to a whole internal market risk model - with enough risk factors to model the full band-width of investments for an insurance company and for a one year time horizon as required in Solvency 2. We demonstrate that the results of a GAN-based internal model are similar to regulatory approved internal models in Europe. Therefore, GAN-based models can be seen as a data-driven alternative way of market risk modeling.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCredit Risk Identification in Supply Chains Using Generative Adversarial Networks

Yu Cheng, Qianying Liu, Xinshi Li et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)