Summary

In this paper we propose a problem-driven scenario generation approach to the single-period portfolio selection problem which use tail risk measures such as conditional value-at-risk. Tail risk measures are useful for quantifying potential losses in worst cases. However, for scenario-based problems these are problematic: because the value of a tail risk measure only depends on a small subset of the support of the distribution of asset returns, traditional scenario based methods, which spread scenarios evenly across the whole support of the distribution, yield very unstable solutions unless we use a very large number of scenarios. The proposed approach works by prioritizing the construction of scenarios in the areas of a probability distribution which correspond to the tail losses of feasible portfolios. The proposed approach can be applied to difficult instances of the portfolio selection problem characterized by high-dimensions, non-elliptical distributions of asset returns, and the presence of integer variables. It is also observed that the methodology works better as the feasible set of portfolios becomes more constrained. Based on this fact, a heuristic algorithm based on the sample average approximation method is proposed. This algorithm works by adding artificial constraints to the problem which are gradually tightened, allowing one to telescope onto high quality solutions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

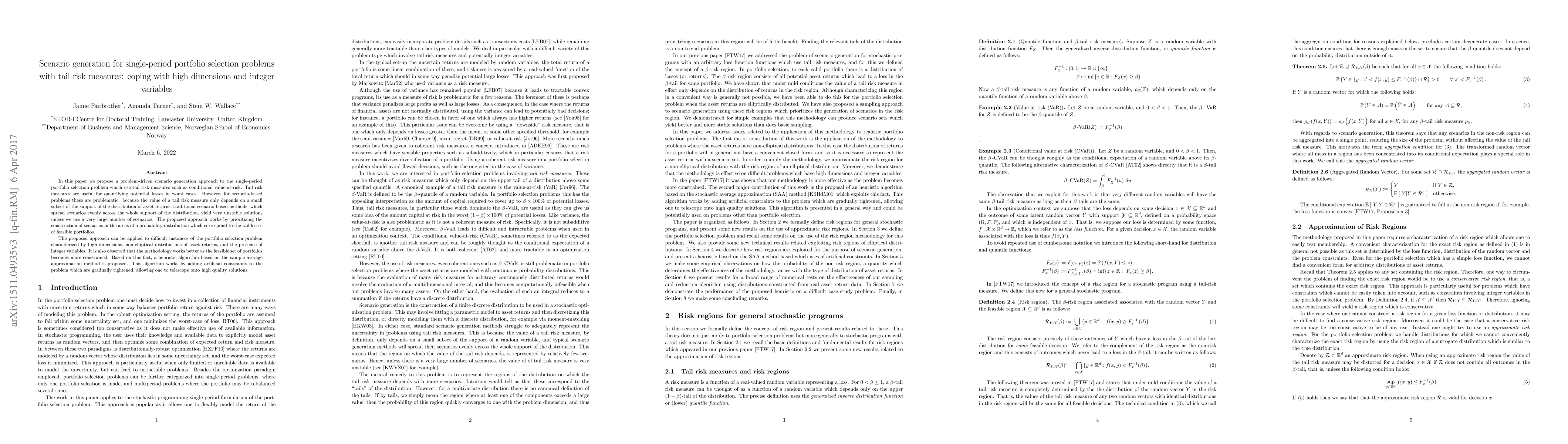

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)