Authors

Summary

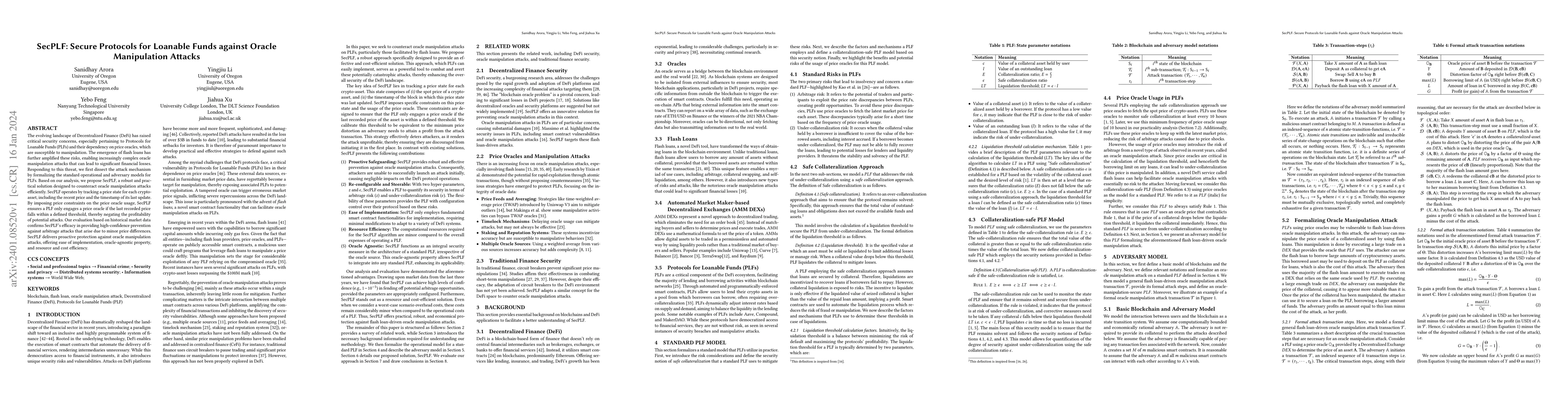

The evolving landscape of Decentralized Finance (DeFi) has raised critical security concerns, especially pertaining to Protocols for Loanable Funds (PLFs) and their dependency on price oracles, which are susceptible to manipulation. The emergence of flash loans has further amplified these risks, enabling increasingly complex oracle manipulation attacks that can lead to significant financial losses. Responding to this threat, we first dissect the attack mechanism by formalizing the standard operational and adversary models for PLFs. Based on our analysis, we propose SecPLF, a robust and practical solution designed to counteract oracle manipulation attacks efficiently. SecPLF operates by tracking a price state for each crypto-asset, including the recent price and the timestamp of its last update. By imposing price constraints on the price oracle usage, SecPLF ensures a PLF only engages a price oracle if the last recorded price falls within a defined threshold, thereby negating the profitability of potential attacks. Our evaluation based on historical market data confirms SecPLF's efficacy in providing high-confidence prevention against arbitrage attacks that arise due to minor price differences. SecPLF delivers proactive protection against oracle manipulation attacks, offering ease of implementation, oracle-agnostic property, and resource and cost efficiency.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSafeguarding DeFi Smart Contracts against Oracle Deviations

Xun Deng, Sidi Mohamed Beillahi, Fan Long et al.

Fine-grained Manipulation Attacks to Local Differential Privacy Protocols for Data Streams

Xinyu Li, Liang Shi, Chia-Mu Yu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)