Summary

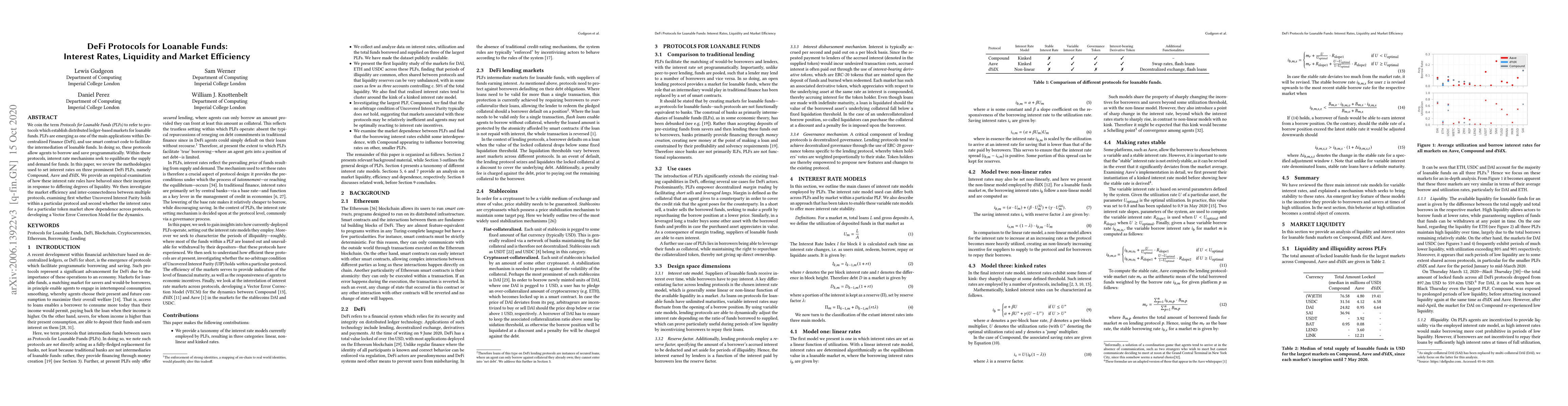

We coin the term *Protocols for Loanable Funds (PLFs)* to refer to protocols which establish distributed ledger-based markets for loanable funds. PLFs are emerging as one of the main applications within Decentralized Finance (DeFi), and use smart contract code to facilitate the intermediation of loanable funds. In doing so, these protocols allow agents to borrow and save programmatically. Within these protocols, interest rate mechanisms seek to equilibrate the supply and demand for funds. In this paper, we review the methodologies used to set interest rates on three prominent DeFi PLFs, namely Compound, Aave and dYdX. We provide an empirical examination of how these interest rate rules have behaved since their inception in response to differing degrees of liquidity. We then investigate the market efficiency and inter-connectedness between multiple protocols, examining first whether Uncovered Interest Parity holds within a particular protocol and second whether the interest rates for a particular token market show dependence across protocols, developing a Vector Error Correction Model for the dynamics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSecPLF: Secure Protocols for Loanable Funds against Oracle Manipulation Attacks

Jiahua Xu, Yebo Feng, Yingjiu Li et al.

A Short Survey on Business Models of Decentralized Finance (DeFi) Protocols

Jiahua Xu, Teng Andrea Xu

DeFi vs TradFi: Valuation Using Multiples and Discounted Cash Flow

Jiahua Xu, Teng Andrea Xu, Kristof Lommers

Optimal risk-aware interest rates for decentralized lending protocols

Damien Challet, Ioane Muni Toke, Bastien Baude

| Title | Authors | Year | Actions |

|---|

Comments (0)