Authors

Summary

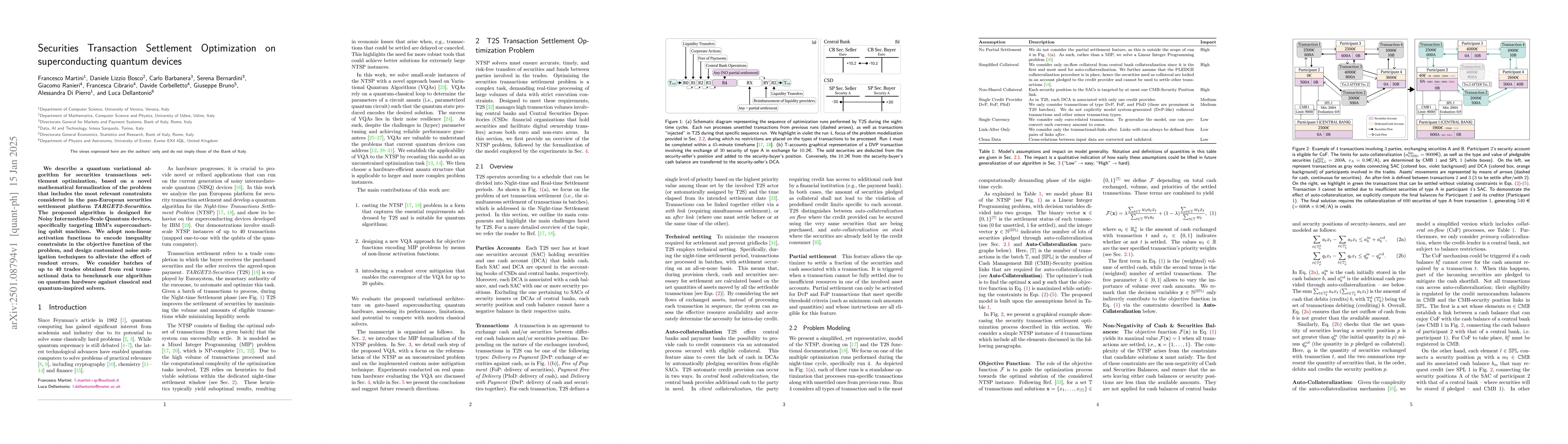

We describe a quantum variational algorithm for securities transactions settlement optimization, based on a novel mathematical formalization of the problem that includes the most relevant constraints considered in the pan-European securities settlement platform TARGET2-Securities. The proposed algorithm is designed for Noisy Intermediate-Scale Quantum devices, specifically targeting IBM's superconducting qubit machines. We adopt non-linear activation functions to encode inequality constraints in the objective function of the problem, and design customized noise mitigation techniques to alleviate the effect of readout errors. We consider batches of up to 40 trades obtained from real transactional data to benchmark our algorithm on quantum hardware against classical and quantum-inspired solvers.

AI Key Findings

Generated Sep 03, 2025

Methodology

The research presents a quantum variational algorithm for optimizing securities transactions settlement, utilizing a novel mathematical formalization of the problem with constraints from TARGET2-Securities. The algorithm is designed for Noisy Intermediate-Scale Quantum (NISQ) devices, specifically targeting IBM's superconducting qubit machines, with non-linear activation functions for encoding inequality constraints and customized noise mitigation techniques.

Key Results

- The proposed algorithm was benchmarked against classical and quantum-inspired solvers using batches of up to 40 trades from real transactional data on quantum hardware.

- iHAMMER, a modified version of the Hamming Reconstruction technique, was employed for error mitigation, showing improvements in the accuracy of the sampling process.

- QTSA, a quantum transaction settlement algorithm, demonstrated performance for up to 35 transactions but was significantly affected by hardware noise for larger instances.

- Q-INSP, a quantum-inspired solver, showed robustness and found valid solutions for instances with 40 transactions, outperforming QTSA for larger problem sizes.

Significance

This work is significant as it advances the application of quantum computing to financial settlement optimization, a critical process in pan-European securities transactions, potentially offering efficiency improvements over classical methods.

Technical Contribution

The paper introduces a quantum variational algorithm with non-linear activation functions for constraint handling and customized noise mitigation techniques, demonstrating its application to a real-world financial problem.

Novelty

The novelty lies in the integration of a complex financial optimization problem (NTSP) with quantum computing, the use of non-linear activation functions for constraint encoding, and the development of iHAMMER for noise mitigation in the context of NISQ devices.

Limitations

- The algorithm's performance is limited by the current capabilities of NISQ devices, particularly susceptible to noise which affects larger circuit sizes and the accuracy of error mitigation techniques.

- The study is constrained by the availability of real quantum hardware, limiting the scale and complexity of instances that can be practically tested.

Future Work

- Exploration of more effective error mitigation techniques tailored to NISQ hardware to enhance the accuracy of the quantum state estimation.

- Scaling up the approach to handle larger and more complex NTSP instances as quantum hardware improves.

Paper Details

PDF Preview

Similar Papers

Found 4 papersExponential Qubit Reduction in Optimization for Financial Transaction Settlement

Dimitris G. Angelakis, Elias X. Huber, Benjamin Y. L. Tan et al.

No citations found for this paper.

Comments (0)