Summary

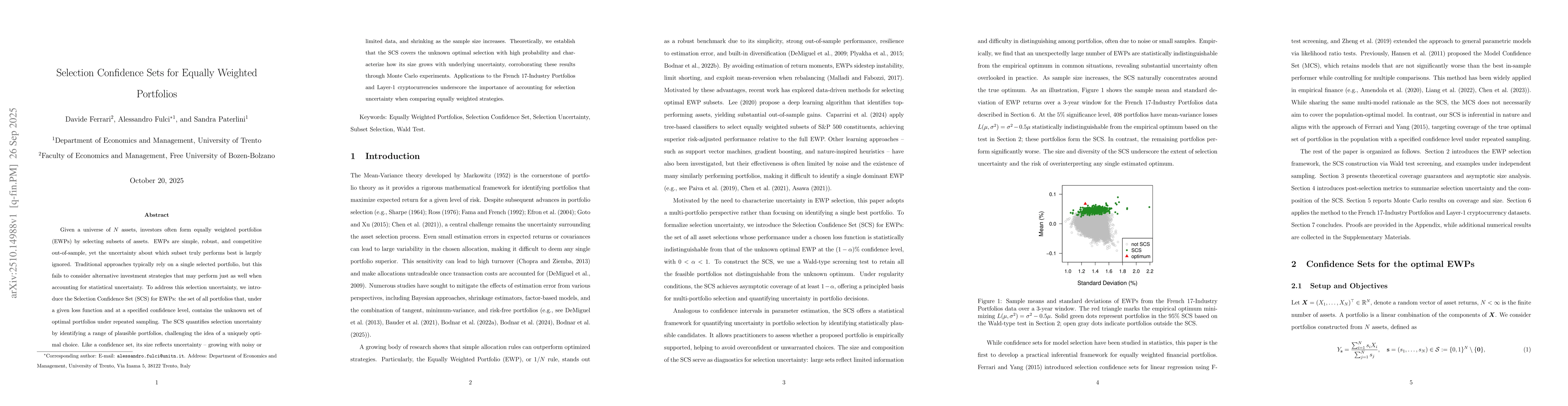

Given a universe of N assets, investors often form equally weighted portfolios (EWPs) by selecting subsets of assets. EWPs are simple, robust, and competitive out-of-sample, yet the uncertainty about which subset truly performs best is largely ignored. Traditional approaches typically rely on a single selected portfolio, but this fails to consider alternative investment strategies that may perform just as well when accounting for statistical uncertainty. To address this selection uncertainty, we introduce the Selection Confidence Set (SCS) for EWPs: the set of all portfolios that, under a given loss function and at a specified confidence level, contains the unknown set of optimal portfolios under repeated sampling. The SCS quantifies selection uncertainty by identifying a range of plausible portfolios, challenging the idea of a uniquely optimal choice. Like a confidence set, its size reflects uncertainty -- growing with noisy or limited data, and shrinking as the sample size increases. Theoretically, we establish that the SCS covers the unknown optimal selection with high probability and characterize how its size grows with underlying uncertainty, corroborating these results through Monte Carlo experiments. Applications to the French 17-Industry Portfolios and Layer-1 cryptocurrencies underscore the importance of accounting for selection uncertainty when comparing equally weighted strategies.

AI Key Findings

Generated Nov 01, 2025

Methodology

The research employs a statistically grounded approach to construct confidence sets for portfolio selection, leveraging asymptotic theory and hypothesis testing to quantify uncertainty in performance estimates.

Key Results

- Confidence sets (SCS) are shown to shrink exponentially with sample size under strong identification

- The methodology provides rigorous coverage guarantees for portfolio selection under various loss functions

- Empirical experiments validate theoretical behavior with coverage approaching nominal levels

Significance

This work addresses a fundamental challenge in portfolio theory by quantifying the abundance of nearly optimal solutions, offering a robust framework for decision-making under uncertainty.

Technical Contribution

Establishes asymptotic coverage properties for confidence sets in portfolio selection using flexible loss functions and hypothesis testing framework

Novelty

Introduces a pairwise hypothesis testing approach to construct confidence sets that capture statistical indistinguishability from the true optimum under specified confidence levels

Limitations

- The approach assumes a fixed number of assets and may face challenges in high-dimensional settings

- Finite sample performance can be suboptimal under weak signal conditions

Future Work

- Exploring incorporation of shape constraints or regularization to refine SCS without compromising coverage

- Extending methodology to high-dimensional settings with appropriate sparsity conditions

Comments (0)