Summary

In this work we analytically solve an optimal retirement problem, in which the agent optimally allocates the risky investment, consumption and leisure rate to maximise a gain function characterised by a power utility function of consumption and leisure, through the duality method. We impose different liquidity constraints over different time spans and conduct a sensitivity analysis to discover the effect of this kind of constraint.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

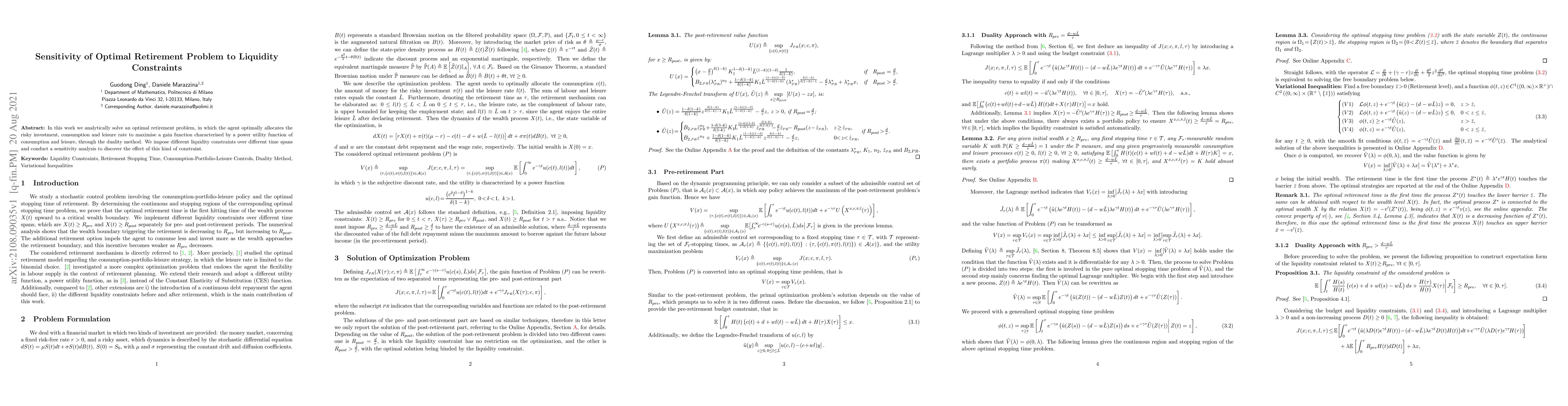

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Strategies for the Decumulation of Retirement Savings under Differing Appetites for Liquidity and Investment Risks

Benjamin Avanzi, Lewis de Felice

No citations found for this paper.

Comments (0)