Authors

Summary

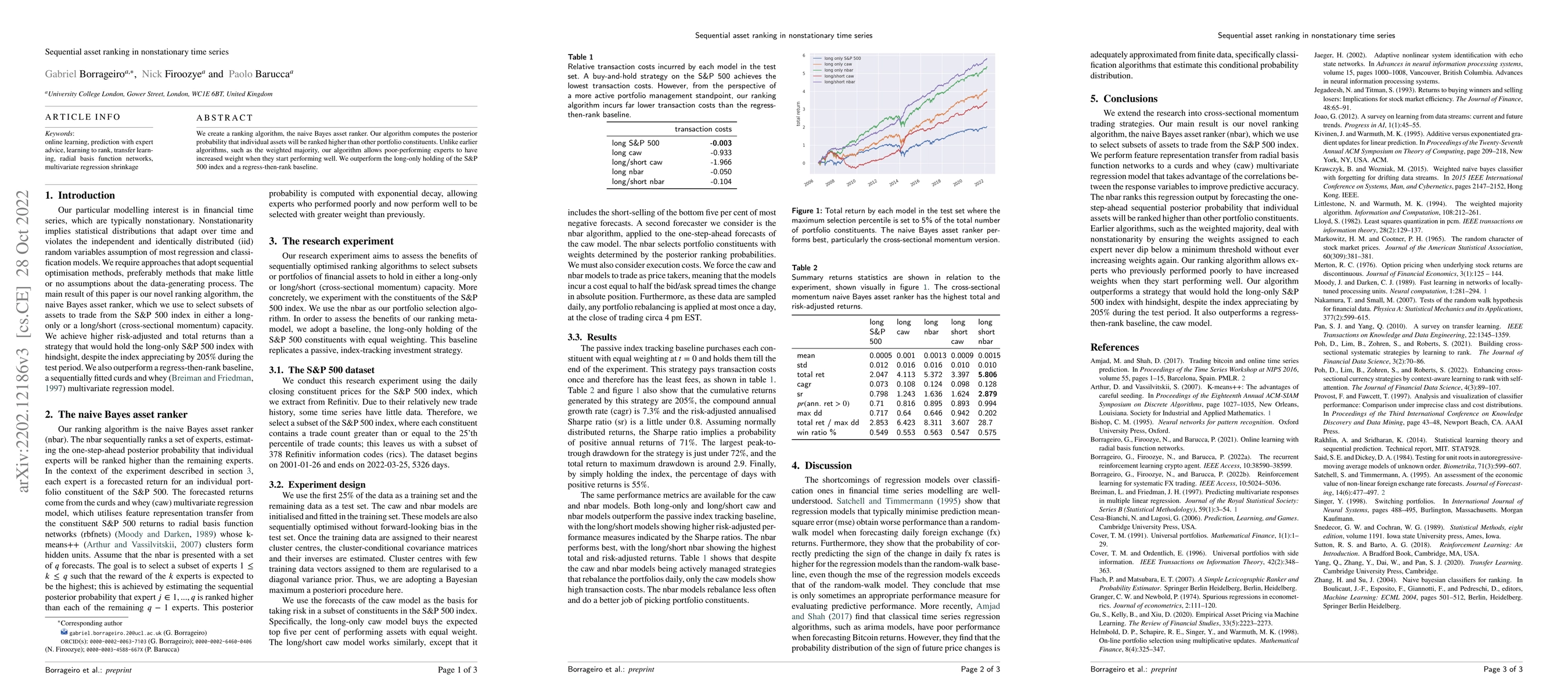

We create a ranking algorithm, the naive Bayes asset ranker. Our algorithm computes the posterior probability that individual assets will be ranked higher than other portfolio constituents. Unlike earlier algorithms, such as the weighted majority, our algorithm allows poor-performing experts to have increased weight when they start performing well. We outperform the long-only holding of the S&P 500 index and a regress-then-rank baseline.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSequential Gaussian approximation for nonstationary time series in high dimensions

Ansgar Steland, Fabian Mies

Graphical models for nonstationary time series

Sumanta Basu, Suhasini Subba Rao

Identifying Unique Causal Network from Nonstationary Time Series

Duxin Chen, Mingyu Kang, Wenwu Yu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)