Summary

We study the relation between serial correlation of financial returns and volatility at intraday level for the S&P500 stock index. At daily and weekly level, serial correlation and volatility are known to be negatively correlated (LeBaron effect). While confirming that the LeBaron effect holds also at intraday level, we go beyond it and, complementing the efficient market hyphotesis (for returns) with the heterogenous market hyphotesis (for volatility), we test the impact of unexpected volatility, defined as the part of volatility which cannot be forecasted, on the presence of serial correlations in the time series. We show that unexpected volatility is instead positively correlated with intraday serial correlation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

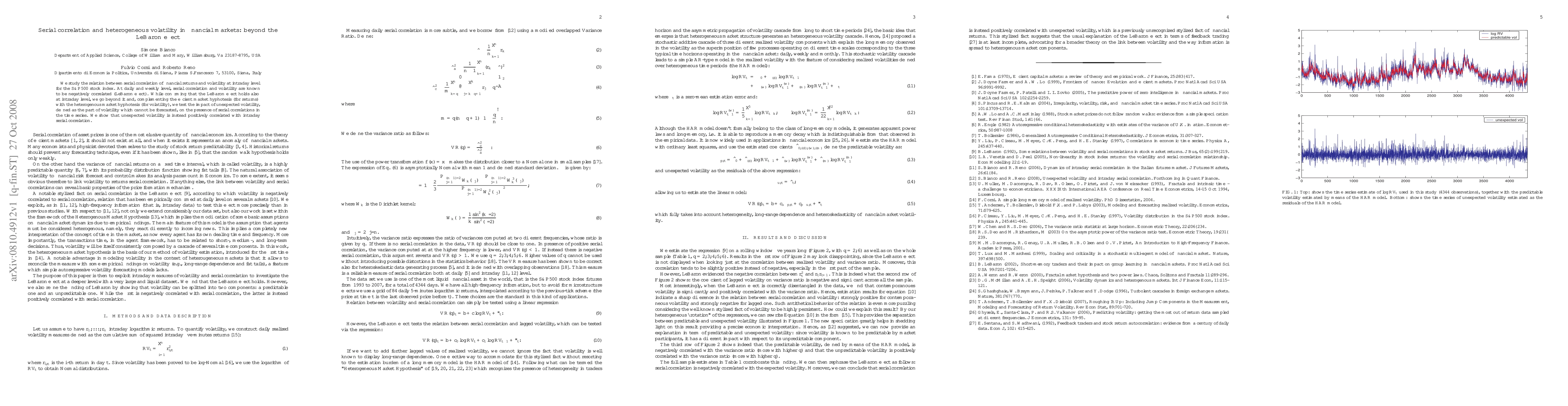

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)